Welcome to the April edition of A Capitol View!

President Donald Trump’s aggressive plans to reform the Department of Defense have picked up steam in recent weeks. He issued a flurry of executive orders aimed at revitalizing shipbuilding, reforming defense acquisition, and reducing barriers to exporting U.S. arms. SMI is closely tracking the implications and helping match our clients with new opportunities.

That also goes for the fallout for the manufacturing and technology sectors from the president’s evolving trade war, particularly with China, as well as Republican plans to extend at least some of the tax cuts that were enacted during Trump’s first term as part of a budget reconciliation package that is under negotiation.

We are trying to influence the fate of one particular tax provision, on the “amortization of research and experimental expenditures.” Starting in 2022, companies could no longer deduct R&D expenses annually but have to write them off over five years. Research suggests that companies, particularly small innovators, have slashed their R&D spending and SMI is hopeful that there is bipartisan support to reverse the change after several fits and starts in recent years.

Numbers game: Meanwhile, budget season is gearing up as we await the president’s blueprint for the next fiscal year in the coming weeks, including what is expected to be a historic increase for the Pentagon. In anticipation, SMI is working with clients to elevate their projects and plans with key lawmakers and funding panels on Capitol Hill.

First moves: The House of Representatives, following the Senate’s lead, passed a budget blueprint in a party line vote that advances Trump’s broad agenda on defense, border security, and government reform, including calling for a $1.5 trillion cut in federal spending over 10 years.

“Approving the budget plan in both chambers is the first step in the reconciliation process, which allows Congress to bypass the 60-vote threshold required to advance most legislation in the Senate and pass Mr. Trump’s agenda with a simple majority,” CBS News reported.

Now onto more of what SMI and our clients have been up to.

SMI SPOTLIGHT

DEEPER BENCH: We are thrilled to announce the addition of Mary Wentworth, who has worked for both appropriators and authorizers in the House and Senate, as a new SMI associate.

DEEPER BENCH: We are thrilled to announce the addition of Mary Wentworth, who has worked for both appropriators and authorizers in the House and Senate, as a new SMI associate.

“Mary brings extensive experience in legislative affairs, defense policy, and appropriations, making her a valuable addition to our team,’ said SMI COO Ken Wetzel.

Mary served as military legislative assistant and policy advisor to Rep. Terri Sewell, a member of the Armed Services Committee and ranking Democrat on the Committee on Ways & Means Oversight Subcommittee. She played a key role in securing legislative successes in the 2025 National Defense Authorization Act and led appropriations efforts across multiple subcommittees.

Previously, she handled energy and homeland security appropriations for Rep. Lauren Underwood, as well as appropriations, tax, transportation, and housing for Sen. Tammy Baldwin. She got her start on the Hill with Senator Tammy Duckworth.

‘Immediate dividends’: Mary will be working closely with SMI Senior VP Jeremy Steslicki. “Mary’s Hill experience, including in the Midwest, will pay immediate dividends for SMI’s growing roster of clients in Wisconsin and Michigan in particular,” Jeremy said. “I am excited to leverage her background in defense and appropriations as well as her bipartisan staff relationships to further grow our shipbuilding and naval research practice area at a time of unprecedented investment and focus related to the U.S. maritime industrial base.”

Mary holds a B.A. in public policy from the University of North Carolina at Chapel Hill. While on Capitol Hill, she was pursuing an M.A. in defense and strategic studies from the Naval War College.

ADVOCACY

PRESSING THE CASE: As we await President Trump’s detailed budget plan for fiscal 2026 later this spring, SMI is pressing ahead aggressively with advocacy efforts on Capitol Hill on behalf of our clients.

PRESSING THE CASE: As we await President Trump’s detailed budget plan for fiscal 2026 later this spring, SMI is pressing ahead aggressively with advocacy efforts on Capitol Hill on behalf of our clients.

In recent weeks we have organized meetings with lawmakers and staff to help shape policy and investments for the battery supply chain and related materials, textile manufacturing, advanced ceramics, shipbuilding, and more.

Convening authority: We also convened strategy sessions and technical conferences for the BATT Coalition, United States Advanced Ceramics Association, and the United States Footwear Manufacturers Association. SMI VP Jeff Leahey supported the National Hydropower Association’s annual Water Power Week, which included sessions with the commissioners from the Federal Energy Regulatory Commission and lawmakers in both parties.

Other examples of our advocacy efforts, in Washington and beyond, included high-level meetings on Capitol Hill with Michigan Wheel, a leader in marine propulsion technology. “The productive discussions focused on how Michigan Wheel’s precision engineering and manufacturing excellence can address critical propulsion needs for naval and marine defense applications,” the company shared.

On the road: SMI also supported SAPA Transmission at the National Defense Industrial Assocation’s Michigan Defense Expo in Warren, Michigan, including engagements with congressional staff and Gov. Gretchen Whitmer, while our COO Ken Wetzel and VP Bryan Bender delivered presentations on the federal budget and communications strategies at the Forging Industry Association’s annual membership meeting in Florida.

In the house: SMI also partnered with the New England Council to host Rep. Lori Trahan of Massachusetts, a member of the Energy and Commerce Committee, for a discussion on trade and other policy matters critical to a region that remains a leading engine of innovation.

TRADE

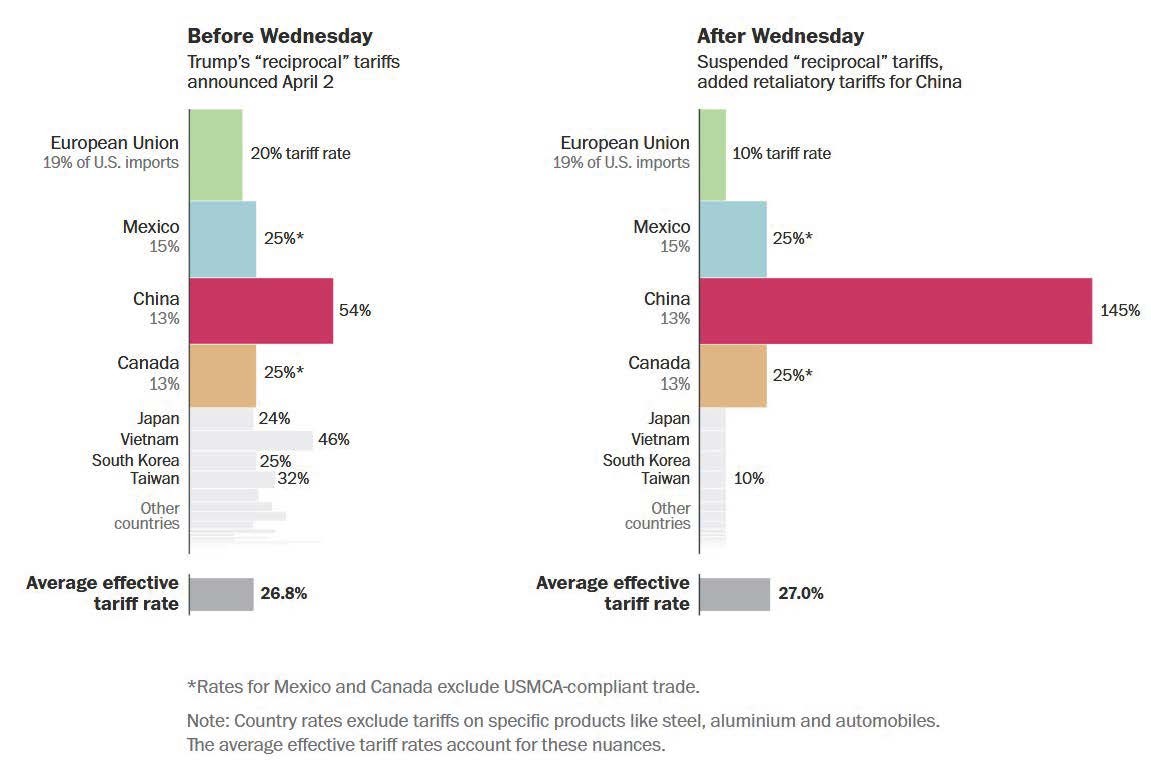

TIT FOR TAT: The Trump Administration paused most of the “reciprocal tariffs” announced April 2, reducing levies to 10% on every country except for China and goods from Mexico and Canada that are not compliant with the United States-Mexico-Canada Agreement. (See Washington Post graphic above)

TIT FOR TAT: The Trump Administration paused most of the “reciprocal tariffs” announced April 2, reducing levies to 10% on every country except for China and goods from Mexico and Canada that are not compliant with the United States-Mexico-Canada Agreement. (See Washington Post graphic above)

The administration subsequently announced it would raise tariffs to 145% on all Chinese imports, and Beijing continues to retaliate, including implementing export controls on rare earth elements and announcing it is raising tariffs on all U.S. imports to 125%.

Between the lines: The White House published a document titled “Annex II” that lists so-called Harmonized Tariff Schedule codes for goods that are excluded from all of the reciprocal tariffs.

“Subject to the tariff exclusions are steel and aluminum products and their derivatives, as well as copper, pharmaceuticals, semiconductors, lumber articles, certain critical minerals, and energy and energy products,” reports SMI Analyst Ben McNutt, who has been closely following the developments. “However, it is important to note not all products within these categories are included in the exclusions, so be sure to check the Annex II list for confirmation on the status of any particular products.”

DEFENSE

‘RAPIDLY REFORM’: Trump is promising a $1 trillion annual defense budget, a historic pledge that would fund some of his most ambitious national security plans. The proposed spike, amounting to roughly 12 percent, would likely be covered in part by cuts to other government programs.

‘RAPIDLY REFORM’: Trump is promising a $1 trillion annual defense budget, a historic pledge that would fund some of his most ambitious national security plans. The proposed spike, amounting to roughly 12 percent, would likely be covered in part by cuts to other government programs.

Some likely new investments include development of the president’s proposed “Golden Dome” missile defense shield in addition to the recent Pentagon decision to select Boeing to build the Next-Generation Air Dominance fighter jet, designated the F-47. Bigger budgets for hypersonic weapons are also expected, along with further expansion of domestic capacity to manufacture munitions.

Ship shape: In his series of executive actions Trump this month issued a new executive order to revitalize and expand the U.S. shipbuilding industry. That includes empowering Elon Musk’s Department of Government Efficiency to begin its own review of the procurement process at the Pentagon and Department of Homeland Security, which oversees the Coast Guard.

Read more: Fact Sheet: President Donald J. Trump Restores America’s Maritime Dominance

Related: New bill would create commission to investigate state of American shipbuilding – Breaking Defense

Cutting red tape: President Trump followed up with an executive order to “rapidly reform our antiquated defense acquisition processes with an emphasis on speed, flexibility, and execution.”

The order gives the Secretary of Defense 120 days to formulate a strategy to reform the acquisition workforce, including “restructuring of performance evaluation metrics for acquisition workforce members to include the ability to demonstrate and apply a first consideration of commercial solutions.” The order also calls for a plan within 180 days to reform the process for formulating weapons requirements, “with the goal of streamlining and accelerating acquisition.”

‘Potential cancellation’: At the same time, the Pentagon has been given 90 days to review all major acquisition programs. “Any program more than 15 percent behind schedule…15 percent over cost…unable to meet any key performance parameters, or unaligned with the Secretary of Defense’s mission priorities, will be considered for potential cancellation,” the executive order states.

Related: Senator Jim Banks Introduces Bill to Speed Up Military Procurement

Plus: Pentagon kicks off major effort to reshape its civilian workforce

And: Defense secretary issues new memo on $5.1 billion in spending cuts

‘Rework our system’: Trump issued another executive order that directs DoD, the State Department, and other agencies “to rework our system of foreign defense sales to ensure that we can provide equipment creating American jobs and … provide key military equipment to our key allies in a reliable, effective way,” said a White House official.

Read more: Trump signs executive order to ease US weapons exports

‘PLATFORM OF CHOICE’: SMI client Govini landed a major contract from the General Services Administration worth up to $919 million over the next decade to deploy its Ark platform to help eliminate supply chain vulnerabilities throughout the defense industrial base.

The deal, sponsored by the Office of the Undersecretary of Defense for Acquisition and Sustainment, is a major milestone for the defense software company.

“Outsourced manufacturing, industry consolidation, and China’s economic aggression have shattered the strength of American supply chains,” said Govini CEO Tara Murphy Dougherty. “Ark is the AI-driven platform of choice for delivering the comprehensive supply chain resiliency the U.S. government needs.”

More from Govini: Trump’s defense-acquisition executive order hits the right notes

More defense news: Defense Innovation Unit unveils advanced manufacturing marketplace

CRITICAL MINERALS

‘IMMEDIATE MEASURES’: SMI is analyzing the implications of numerous plans by the Trump administration and Congress to reduce our reliance on foreign sources for critical minerals that support national defense, energy, transportation, and other key sectors of our economy.

‘IMMEDIATE MEASURES’: SMI is analyzing the implications of numerous plans by the Trump administration and Congress to reduce our reliance on foreign sources for critical minerals that support national defense, energy, transportation, and other key sectors of our economy.

President Trump signed an executive order that called for “immediate measures” to increase domestic production, including fast-tracking permitting, leasing, and financing of domestic mining projects. One focus is leveraging military bases, which include vast tracts of mineral-rich land.

“With the Pentagon controlling 30 million acres of land, this approach avoids typical local opposition to siting facilities and eliminates the need to purchase land or use areas controlled by other federal departments,” said SMI Analyst LB Fullerton, who has been closely tracking the developments for a range of clients.

Head honcho: The president also named David Copley, a former executive at mining company Newmont Corporation, as his Critical Minerals Czar, where he will oversee the mining portfolio at the recently established U.S. National Energy Dominance Council.

LB has also been tracking more ambitious efforts in Congress to reduce U.S. reliance on foreign minerals, including a series of bills that have been proposed so far this year:

· Critical Materials Future Act

· Critical Mineral Consistency Act

Read more: Fact Sheet: President Donald J. Trump Takes Immediate Action to Increase American Mineral Production

Client spotlight: Critical minerals versus Mother Nature: Digging into the future of an upcoming Arizona mine

Plus: Trump signs executive order boosting coal industry

ENERGY

‘SACRED COW’: The hits just keep on coming to the Department of Energy’s clean energy programs but lawmakers in both parties are raising alarms that many of the projects on the chopping block are critical for new technologies like hydrogen production and carbon capture and must be a key component of achieving energy independence.

“An initial list of projects that had been eyed for elimination included $8 billion for hydrogen hubs, $7 billion for carbon capture hubs, $6.3 billion for industrial demonstrations, $500 million for long-duration energy storage, $133 million for the Liftoff program for accelerating new technology development and $50 million for distributed energy programs,” POLITICO reported.

Not so fast: The proposed cuts, developed by the controversial Department of Government Efficiency headed by tech billionaire Elon Musk, appear to be headed for bipartisan resistance on Capitol Hill.

“Somebody’s DOGE victory is somebody else’s sacred cow,” said Sen. Kevin Cramer (R-N.D.). “That’s sort of what we’re running up against with this broad approach.”

‘All-of-the-above’: Rep. Dan Newhouse (R-Wash.) said he is making the case for a planned hydrogen hub in the Pacific Northwest – in Washington, Oregon and Montana – calling it “part of an all-of-the-above energy portfolio that has a future worth exploring.”

The hub could receive $1 billion in federal funding and use renewable energy to produce hydrogen for heavy-duty trucking, agriculture and port operations.

‘Indiscriminate cancellations’: Two dozen Senate Democrats also banded together to fight the cuts. “Dissolving contracts, cancelling grants and loans, and reneging on loan guarantees without any intention to execute the laws is not only illegal, but is harmful to the public and energy consumers,” they wrote to Energy Secretary Christopher Wright. “Your indiscriminate cancellations of spending will increase energy prices, make our grid less secure, and stop energy innovation.”

TECHNOLOGY

‘CRITICAL MISSION OBJECTIVES’: SMI is supporting a coalition of technology firms that are urging Congress to permanently reauthorize the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs.

The New England Innovation Alliance, which represents dozens of companies in Massachusetts, New Hampshire, Vermont, Rhode Island, and Connecticut, is urging lawmakers to expand access to the competitive federal awards but also ensure that the unique needs of “mission agencies” like the Department of Defense that rely heavily on them are not undermined.

“NEIA members are not typically single-technology companies on a linear venture-capital driven trajectory,” the alliance told the Senate Committee on Small Business & Entrepreneurship. “They focus on innovating technologies that federal agencies, like the U.S. Department of Defense (DoD) and its service branches, need to meet critical mission objectives, for which no other stakeholders are positioned to deliver.”

The experienced SBIR firms outlined a series of principles to guide the reauthorization process:

- Merit-based Awards: “Congress should maintain the competitive, merit-based fundamentals of the program to ensure the best technology is developed to keep America as the world leader.”

- Application Simplification: “The largest barrier to participation in the program for new entrants is the increased administrative burden and complexity of proposal submission

- Improved Communication: “Agencies should be required to improve the communication of their needs and opportunities to small businesses across all topic types.”

- Agency Discretion: “Agencies should have discretion to shape the program and define merit consistent with their missions.”

- Permanent Authorization: “Companies make investments based on an assessment of their ability to grow and recover that investment…Program permanency reduces the perception that those investments will be stranded at the next reauthorization without limiting the ability of Congress to make further adjustments to the program.”

New intel: Navy releases SBIR topics

‘POWERFUL MOMENTUM’: Congrats to SMI client University of Massachusetts Lowell and Draper on the opening of the defense and space technology leader’s new office on campus.

Draper is an anchor tenant of the Lowell Innovation Network Corridor (LINC), the transformative public-private partnership unveiled last year in partnership with the City of Lowell and Commonwealth of Massachusetts.

The LINC will support Draper’s Electronic Systems business, which focuses on specialized microelectronics for the military, critical infrastructure, and space exploration markets.

‘Long-term opportunity’: “When leading companies like Draper partner with top-tier public research universities like UMass Lowell, it creates powerful momentum for innovation, workforce development and regional growth,” said Lieutenant Governor Kim Driscoll. “This is exactly the kind of collaboration our administration is proud to support — partnerships that fuel economic development, build a strong talent pipeline, and create long-term opportunity for communities across Massachusetts.”

Read more: Draper Officially Opens Its Newest Campus at UMass Lowell

CLIENTS IN THE NEWS

U.S. Footwear Makers Push Washington to Prioritize ‘Made in the USA’