What’s Going on in Congress?| Appropriations, the Inflation Reduction Act, and CHIPs & Science Act

Appropriations Timeline

Nearly four weeks remain until October 1, the start of Fiscal Year (FY) 2023 Congress’s deadline to pass all 12 appropriations bills to fund the government. While the House and Senate have released their own versions of each bill, consensus on topline numbers and spending priorities have stalled between the two chambers.

Three major sticking points between the House and Senate appropriations bills:

- Topline Numbers: The House followed the President’s Budget Request (PBR), funding $762 billion, meanwhile the Senate added $30 billion, totaling $793 billion—a $64 billion increase from FY 2022. The Senate justification was primarily inflation.

- Shipbuilding: The House followed the PBR, funding $27.8 billion for eight ships, while the Senate added $4 billion for ships, specifically, a third destroyer and two expeditionary medical ships.

- Aircrafts: The House and Senate deviated on procurement of major aircraft programs. The House followed the PBR, funding 61 F-35 fighters, while the Senate funded 67. The House diverged from the PBR funding 18 F-15EX, while the Senate matched the PBR’s request for 24. The Senate also added $1.7 billion on top of the service’s budget for 16 C-130Js for the Air National Guard and five V-22 tiltrotor aircrafts.

More likely than not, before October 1st, Congress will pass a Continuing Resolution (CR) to keep the federal government open, which has become common in recent years. A CR will freeze government funding at the current levels when FY 2023 begins on October 1. The House Freedom Caucus sent a letter to House and Senate Minority Leaders Rep. Kevin McCarthy (CA-23) and Sen. Mitch McConnell (KY) requesting that they reject any potential omnibus government funding package ahead of October 1.

Historically, Congress will pass a CR that will expire in the December time frame with the goal of wrapping the annual appropriations process by the holidays. However, last year Congress did not pass an Omnibus Appropriations bill until the end of February. Both the Chairman, Pat Leahy (VT) and Ranking Republican, Richard Shelby (AL), of the Senate Appropriations Committee are retiring and both have expressed an interest in finishing the process before they leave office.

Inflation Reduction Act is Signed into Law

Sunday, August 7, the Senate passed the Inflation Reduction Act of 2022, 51-50, with Vice President Kamala Harris casting the deciding vote. Friday, August 12, the House passed the legislation along party lines, 220-207. The $430 billion bill was signed into law by President Biden Tuesday, August 16.

The Inflation Reduction Act is a greatly modified version of the reconciliation package, aka the Build Back Better Plan, that President Biden ran on in 2020 and that the Democrats have worked on for the past year. The Act is intended to address deficit reduction to fight inflation, as well as provide major investments in domestic production and manufacturing, an extension of the Affordable Care Act, and an expansion on climate change initiatives.

Highlights from this major piece of legislation include:

- Expansion of Medicare Benefits: The Inflation Reduction Act makes significant changes to Medicare drug pricing, spending limits and monthly premiums. Most notably, the bill allows Medicare to negotiate prescription drug pricing. Based on a Senate estimate, prescription drug pricing reform is expected to bring in $265 billion in federal revenue.

- Corporate Tax Reform: The Inflation Reduction Act sets a 15% minimum corporate alternative tax on corporations averaging over $1 billion in earnings. The Congressional Budget Office (CBO) estimates that the new tax will bring in $222 billion in federal revenue.

- Energy and Climate Investments: The bill invests $369 billion in energy and climate reform, including over $200 billion in clean energy credits for individuals and industry actors. In addition to clean energy credits and incentives, $60 billion will be invested towards building a strong domestic clean energy manufacturing workforce, and another $60 billion is to be spent on environmental justice initiatives in historically underserved communities. Climate provisions in the bill are expected to reduce emissions by 40% by 2030.

- Internal Revenue Service Expansion: The bill allocates $80 billion to the Internal Revenue Service (IRS) to be spent over the next ten years. New investments will go towards tax enforcement, modernization efforts, and efficiency improvement.

Although the bill, scored by the CBO, will not have a major impact on mitigating inflation, it is expected to reduce federal deficits by $100 billion over the next ten years.

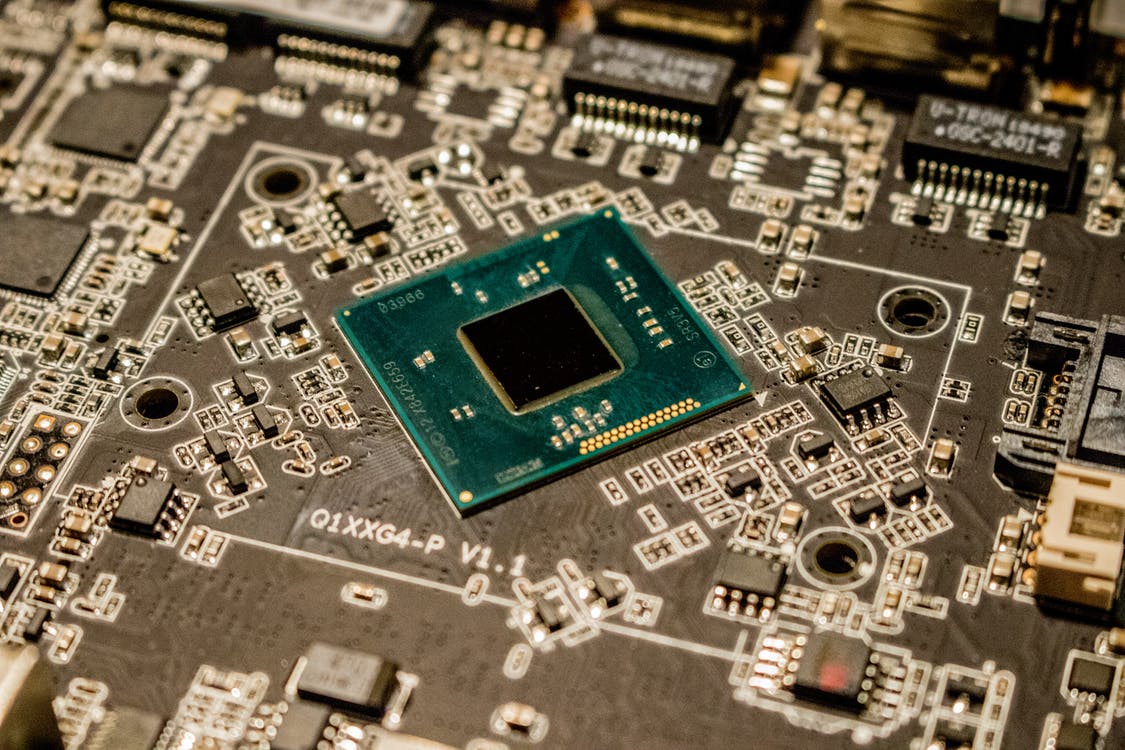

CHIPs and Science Act is Signed into Law

President Biden signed the CHIPs and Science Act into Law on Tuesday, August 9. This legislation, championed by Majority Leader Sen. Chuck Schumer (NY) and Sen. John Cornyn (TX), is designed to spur the domestic manufacturing and supplier base of semiconductors in the United States.

Funding allocated within this legislation is under a five-year authorization. Highlights from this legislation are as listed below.

- $52 billion for domestic semiconductor manufacturing: This investment includes $39 billion for semiconductor manufacturing incentives, $11 billion for microelectronics workforce development and education (including a new National Semiconductor Technology Center), and $2 billion for a CHIPs for American Defense Fund to go to the Microelectronics Commons national network for defense-specific microelectronics research.

- $81 billion for the National Science Foundation: $20 billion of this investment is apportioned towards the establishment of an NSF Directorate for Technology, Innovations and Partnerships (TIP), designed to address key challenges to critical technology advancement, science security and workforce readiness. The remaining $61 billion is distributed across NSF core activities to support critical research-enabling infrastructure and broaden participation in the U.S. innovation economy.

- Increased capacity for the Department of Energy: Increases the Department of Energy’s Office of Science budget by 50%. Investments in the Office of Science are intended to greatly expand the Office’s research capacity, authorizing the creation of several new R&D centers focused on sustainable chemistry, materials science and computational materials. The Office will also see the establishment of a new materials research database.

- Historic investments in climate infrastructure and technology: The CHIPS Act directs an estimated $67 billion towards the expansion of zero-carbon industries and climate research distributed across the NSF, DOE and National Institute of Standards and Technology. This represents almost a quarter of the bill’s total funding.

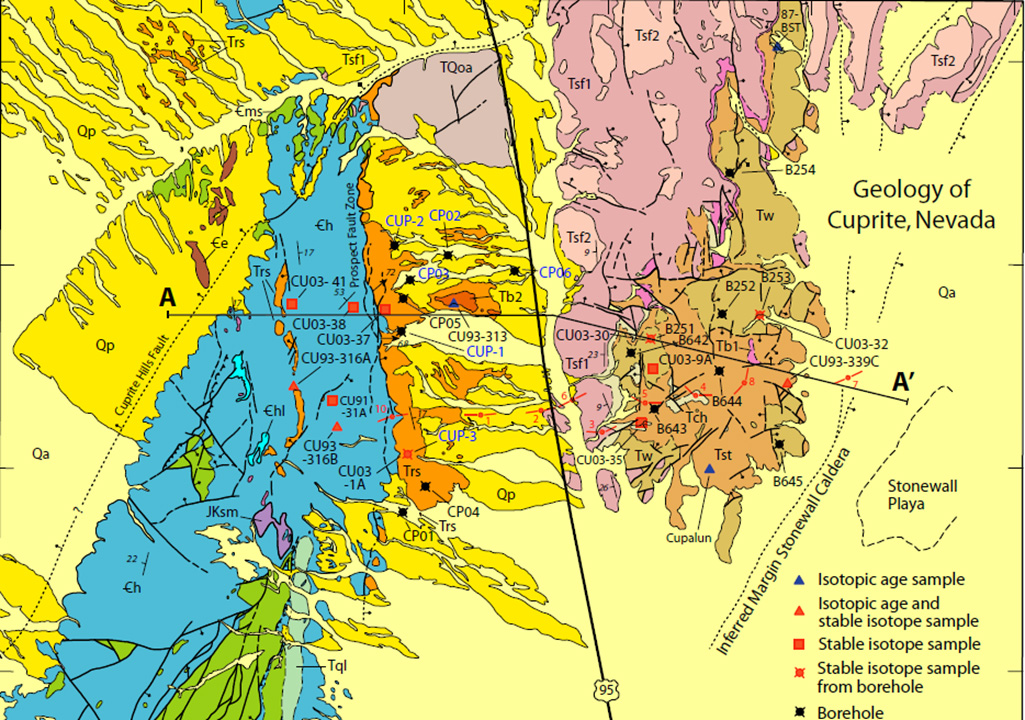

Defense Advanced Research Projects Agency Moves to Automate Critical Mineral Assessments

The Defense Advanced Research Projects Agency (DARPA) and the United States Geological Survey (USGS) have partnered to explore the potential for machine learning (ML) and artificial intelligence (AI) tools to accelerate critical mineral assessments by automating key steps in the process.

The Energy Act of 2020 called for USGS to assess all critical mineral resources in the U.S. The Bipartisan Infrastructure Law called on the USGS to assess potential critical mineral resources in mining waste. These assessments can quantify potential mineral sources from existing domestic mines – whether historical or active – and help identify opportunities for economically and environmentally viable resource development. However, the assessment process is time-consuming, and DARPA and USGS are seeking to accelerate this process in order to meet the current and future needs of domestic manufacturers by using AI.

There are 50 minerals listed as critical to the US domestic supply chain. These minerals are used in aerospace components, batteries, and more.

Life Science Update with Evan Dorner

SMI’s newest life science member, Evan Dorner, shared his insights on the upcoming major legislative issues facing the industry.

FDA User Fee Agreements

Congress first passed the initial FDA User Fee Agreement (UFA), known as the Prescription Drug User Fee Agreement (PDUFA) in 1992 and has done so every five years since then. PDUFA mandates FDA collect application user fees from prescription drug, medical device, and generic manufacturers to fund the majority of the drug approval process. In return, FDA must maintain agreed upon approval processes and benchmarks.

Congress first passed the initial FDA User Fee Agreement (UFA), known as the Prescription Drug User Fee Agreement (PDUFA) in 1992 and has done so every five years since then. PDUFA mandates FDA collect application user fees from prescription drug, medical device, and generic manufacturers to fund the majority of the drug approval process. In return, FDA must maintain agreed upon approval processes and benchmarks.

The sixth authorization of PDUFA, H.R. 7667, passed the House of Representatives on June 8th with a vote of 392-28 awaits consideration in the Senate. However, Sen. Richard Burr (NC), Ranking Member of the Senate Health, Education, Labor and Pensions Committee introduced a simple re-authorization, which would re-authorize the PDUFA V passed in 2017 and disregard H.R. 7667, raising concerns that the Bill could be held up in the Senate. The Bill must be signed into law by September 30, 2022, otherwise the FDA will be forced to lay off a significant part of their workforce, who already face a backlog of new drug applications due to the ongoing COVID-19 health crisis.

Advanced Research Projects Agency for Health (ARPA-H)

Congress has started moving forward with ARPA-H by appropriating $1 billion in the FY 2022 spending package. However, an authorization outlining key details regarding how the agency would operate, be organizing, and receive funding have yet to be set. At the moment, Health and Human Services (HHS) Secretary, Xavier Becerra, has announced he wants ARPA-H under the National Institute of Health (NIH) budget.

This proposal is similar to ARPA-H Act, introduced by Sen. Patty Murray (WA) and Sen. Richard Burr (NC), establishing ARPA-H within the NIH. However, Rep. Anna Eshoo (CA-18), has introduced a bill proposing a clean break from the NIH, making ARPA-H an independent agency. Independence from the NIH would allow ARPA-H to act as an independent body, investing in calculated high-risk, high-reward research projects to accelerate breakthroughs within the field of health and medicine. While it is unlikely that ARPA-H will pass a standalone bill, interested parties are pushing to include authorization of the program in the likely year-end healthcare extender package.

While it is unclear how ARPA-H will function, multiple states are vying to be home to its headquarters. The following states are all attempting to make their case to HHS Secretary, Becerra, that they would make the best headquarter for the new agency:

- California

- Georgia

- Illinois

- Maryland

- Massachusetts

- Missouri

- North Carolina

- Ohio

- Pennsylvania

- Texas