Welcome to the February edition of A Capitol View

The new session of Congress has not been without its bumps, but January saw real movement on federal spending and tax legislation that is considered crucial to encouraging private-sector innovation.

The big picture: Congressional leaders finally an reached agreement on the overall level of federal appropriations for fiscal year 2024, more than four months after the start of the fiscal year – but only after approving another temporary measure to keep agencies running at current spending levels.

The annual spending pact calls for setting aside $886 billion for defense and $773 billion for other federal agencies. Non-defense budgets would remain roughly flat compared to current levels. But defense spending would see a three percent increase.

Between the lines. The individual agency totals have not yet been released but the Department of Energy could get a slight boost, while the Environmental Protection Agency and Department of Interior could see modest cuts, E&E News reported.

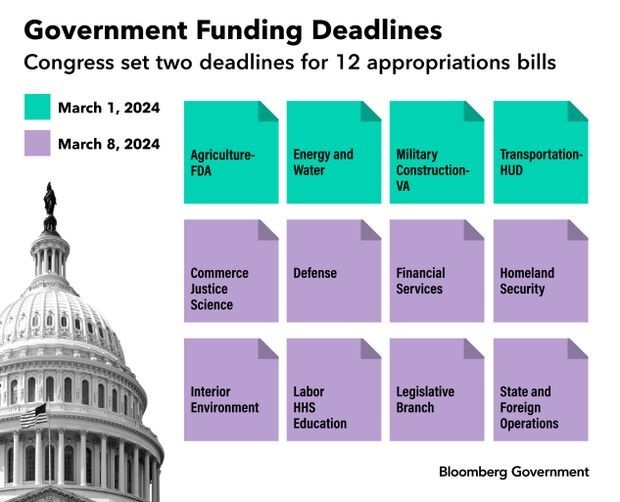

Looming deadlines: Government funding runs out for some agencies on March 1 and others a week later. Leaders in both parties have their work cut out to placate fiscal conservatives who are demanding House Speaker Mike Johnson pursue additional cuts to non-defense spending.

“Appropriators are in a mad dash to meet their March deadlines to wrap up fiscal year 2024,” said SMI Director Nick Vance, who just joined the firm from the staff of the House Defense Appropriations Defense Subcommittee. “The Committees will likely adhere to the national security funding level agreed upon in the Fiscal Responsibility Act, or $886 billion.

“This funding will be split among several subcommittees that receive national security funding,” he added, “and we expect the final defense appropriations bill to be between the House-passed level of $826.16 billion and the Senate’s level of $823.78 billion.”

Those totals are just for the Pentagon and do not include national security spending at the Department of Energy or military construction costs.

Ukraine and Israel aid: The prospects seem far less clear on whether the House and Senate can come to agreement on the Biden administration’s $118.28 billion emergency spending package for Ukraine and Israel aid and to beef up security on the southern border.

The Republican-led House plans to take up aid to Israel separately after Speaker Mike Johnson accused the Democratic-controlled Senate of shutting out the House in negotiations on its fuller package set to come to the floor as early as this week.

If the Senate can muster a broad bipartisan majority for passage, pressure will grow on the House to fall in line, despite pressure from presumptive Republican presidential nominee Donald Trump to kill the bipartisan border measures.

‘Shifting priorities’: It is possible that some of the emergency funding could also end up in an annual appropriations package.

“Some of the increases that were designated as emergency spending may be included in the final bill at the expense of other programs,” according to Nick. “This all means that, unlike the past two fiscal years, appropriations will have to make tough choices to meet their topline. This includes walking off of increases, making deeper cuts, or shifting priorities.”

‘A level of uncertainty’: Nick added that while the subcommittee staff will quickly move through technical and programmatic issues in the next week, leaders could stumble “on the litany of politically charged policy riders that were included in the House bills.”

“This injects a level of uncertainty about potential final passage if House conservatives are unhappy with whatever deal is reached on these riders,” he said.

Get busy: Regardless, the process for building the fiscal 2025 federal budget is already rolling. Biden plans to submit his next budget request to Congress on March 11, just days after the 2024 funding deadlines.

Read more: Here’s What’s in the Senate’s $118 Billion Ukraine and Border Deal.

A taxing journey: In what would be a big win for SMI clients, a bipartisan tax package that passed the House last month would “devote $33 billion to reviving a trio of business tax breaks and roughly the same amount to expand the child tax credit,” as Roll Call reported.

One of the biggest proposed changes would allow companies to resume deducting expenses for research and development on an annual basis, instead of every five years – a reform enacted in 2017 that caused serious fiscal problems for companies large and small and across industries.

SMI senior advisor David Maas, who has been organizing a coalition of companies to lobby Congress on the tax issue, broke down the latest developments and what they mean, especially for smaller companies:

Why has this been such a widespread concern?

Larger firms saw much higher tax bills from their efforts to improve their offerings by performing innovative R&D or even developing new software. Some smaller firms, especially those whose primary business was performing [research and development] for the government through programs like Small Business Innovation Research], face bankruptcy from this tax provision.

How does it address those concerns?

It eliminates this problem for the 2022 to 2025 tax years.

Why is this development so politically promising?

The bill is a rare bipartisan compromise that passed by a huge margin of 357-70. Bipartisan compromise is not a phrase heard often these days in Washington, especially regarding taxes. Many groups and firms like SMI have worked together this past year to promote awareness of the problem and build support for this bill.

What’s next before it can become law?

The bill now goes to the Senate, and its prospects for passage there are very uncertain. Despite the lopsided support in the House, at least 10 senators have voiced strong reservations and have made clear that if their concerns are not addressed, they will oppose the bill. If so, 60 votes will be needed for passage.

Should it pass, the White House has said they will sign it. Industry continues to let Congress know how important this is, but only time will tell if and how this issue is resolved.

SMI SPOTLIGHT

SMI deepened its bipartisan bench this month by adding as its newest Director Nick Vance, most recently a professional staff member for the House Appropriations Defense Subcommittee, to enhance our expertise in federal appropriations.

Nick has served as a key advisor to senior House members and military leaders and will provide valuable insight and direction for our national security clients, particularly those working in defense procurement and research, development, test and evaluation.

He was previously legislative director for Rep. John Rutherford (FL), professional staff member for Rep. Kay Granger, the Appropriations Committee chair, and a congressional liaison for the Air Force on budget issues.

“Nick brings SMI and our clients the unique experience and insights that comes with having been a professional staff member on the HAC-D,” said SMI CEO Bill McCann. “What distinguishes Nick, though, is his work ethic, his commitment to teamwork and his reputation amongst his former colleagues and the national security community as a results-driven but collegial professional.”

“It’s an honor to join the team at SMI,” Nick said. “I look forward to partnering with companies that are seeking to contribute to our national security. My direct experience on the Defense Appropriations Subcommittee will help them navigate the congressional appropriations process and enhance their relationships with the Department of Defense.”

New advisor: SMI has also brought on as a senior adviser Jason Mello, a retired Air Force colonel and former president of Firefly Aerospace, where he forged contracts with Lockheed Martin and L3Harris and steered the acquisition of launch provider’s first U.S. Space Force contract.

The additions follow a series of recent hires as we strengthen our defense, space, and energy portfolios.

Check out our first-class roster of senior advisors.

STRATEGIC COMMUNICATIONS

SMI Director Karlee Popken and VP Bryan Bender organized a public briefing on Feb. 6 for congressional staff on the Small Business Innovation Research and Small Business Technology Transfer (SBIR/STTR) programs.

“America’s seed fund” has a long record of helping federal agencies leverage innovative companies and research universities to meet national security, energy, and public health needs. Congress is preparing to reauthorize the programs in 2025.

Innovators, Inc.: The event included opening remarks by Rep. Seth Moulton of Massachusetts and a panel discussion featuring Dr. Maryann Feldman, professor of public policy and management at Arizona State University and co-chair of the National Academy of Sciences’ ongoing reviews of SBIR/STTR programs at the Department of Defense and NASA; Bill Marinelli, president and CEO of Physical Sciences, Inc.; and Christopher Hemmelgarn, president of Cornerstone Research Group.

Stay tuned for a full recording of the event and briefing materials.

Related: DOE releases SBIR funding opportunities.

DEFENSE

MATERIAL WORLD: SMI’s capacity to convene decision makers and thought leaders was also on display at the inaugural Advanced Materials Summit we hosted last month with support from Cerion Nanomaterials and EWI, in partnership with the Office of the Secretary of Defense.

The two days of policy and technical discussions focused on overcoming barriers to transitioning novel materials and manufacturing processes into defense acquisition programs and rebuilding the workforce needed to flex our industrial might.

Get it together: A major emphasis was on how government, industry and academia can better collaborate to ensure we have the resilient supply chains for critical materials to maintain our technological edge and the manufacturing capacity to deter our adversaries.

On hand were a broad range of participants, from research labs and lower tier suppliers to military program offices, top DoD officials, and prime contractors, who all kick-started an overdue and urgent conversation.

More to come: Stay tuned for information on the next gathering, as we keep the momentum going to support DoD’s efforts to make the right investments and policy choices that lead to more rapid, cost effective, and stronger outcomes for our warfighters.

‘RAPID EXECUTION’: The Defense Production Act has been a primary means for DOD to make critical investments in the industrial base and a new Defense Industrial Base Consortium “will enable rapid research and allow access to commercial solutions for defense requirements and innovations from industry, academia, and non-traditional contractors, the Pentagon announced.

Growth potential: The Pentagon selected Advanced Technology International to manage the consortium. Laura Taylor-Kale, assistant secretary of defense for industrial base policy, said the revised structure “will not only help stimulate the growth of the defense industrial base, but it will also enable more rapid execution of Defense Production Act funding.”

“Additionally,” she said, “this helps us execute the National Defense Industrial Strategy, address defense supply chain pain points, develop the industrial workforce, sustain critical production, and allow for complementary investments from other federal agencies to build a robust, resilient, and modernized defense industrial ecosystem.”

Shorter timelines: SMI Director Tas Ingram said the new approach should help clear bottlenecks with DPA Title III funding in particular, which now relies on Air Force contracting.

The “other transaction authority” could be used by both DPA III and the related Industrial Base Analysis and Sustainment program. “That will shorten time to contract,” Tas said.

Focus areas: The industrial base priorities include kinetic capabilities; energy storage and batteries; castings and forgings; microelectronics; critical chemicals and minerals; small unmanned aerial systems; rare earth elements; critical materials; submarine industrial base; space industrial base; and biomanufacturing.

In case you missed it: DOD Releases First-Ever National Defense Industrial Strategy.

NEED FOR SPEED: It’s time to take more ambitious measures to wean the U.S. military off Chinese-made batteries, Jeffrey Nadaner, senior vice president at SMI client Govini, the defense acquisition software company, testified Feb. 1 to the U.S.-China Economic and Security Review Commission.

Nadaner called for provisions in the upcoming National Defense Authorization Act that he said would “accelerate the Department of Defense’s move away from reliance on Chinese-based battery materials.” They include:

– a phased-in schedule “to move sourcing of battery materials and components used for weapons and critical infrastructure exclusively towards supply chains secure from Chinese coercion or control”; and

– requests for proposals “with dollar targets and certain contracts awarded under the condition that Chinese battery components are not used.”

‘Complications and concerns’: “The U.S. Department of Defense faces the same battery supply chain challenges and vulnerabilities as the private sector, but with added complications and concerns,” he testified. “Weapons have used batteries since the invention of stored electricity, but newer military systems and modes of operation have increased their significance to national defense.”

ENERGY

‘HARNESS THE POWER’: SMI client OPALCO, the Washington state non-profit cooperative utility, was selected for one of two awards totaling $6 million from the Department of Energy to deploy a tidal energy turbine in Rosario Strait in the San Juan Islands.

“The device is expected to be capable of producing about 2 megawatts of power,” the agency said in an announcement. “OPALCO aims to develop a pilot tidal power program to provide a reliable and resilient local power supply for San Juan Islanders.”

“With marine energy we can sustainably harness the power of the ocean and rivers, providing rural and remote communities with clean reliable power,” said Energy Secretary Jennifer Granholm.

She said the projects “are part of the largest investment by the federal government to advance the technology to capture energy from ocean tides and river currents” and will help to decarbonize hard-to-reach coastal communities and increase their energy independence and resilience with locally generated energy.

The announcement is the first of five phases in a $35 million investment under the Bipartisan Infrastructure Law.

POWERING UP: The United States Advanced Battery Consortium LLC was awarded $60 million from the Department of Energy for research and development to support wide scale electric vehicle commercialization.

The consortium is wholly owned and managed by SMI client the United States Council for Automotive Research, whose members are Ford Motor Company, General Motors and Stellantis.

Big goals: Their proposal set out goals to advance battery cell technology to enhance performance and reduce costs; develop a robust domestic supply chain to ensure mass adoption of EVs.; implement end-of-life battery recycling; and develop battery cells for EVs ranging from light- to heavy-duty applications.

“We look forward to engaging new partners to further our mission,” said Steven Przesmitzki, executive director of USCAR, which is dedicated to developing new technologies that advance next-generation EV applications.

The announcement was part of a series of new DOE investments to boost America’s battery supply chain and the adoption of electric vehicles.

PUBLIC AIRING: The IRS held a public hearing Jan. 31 to hear industry concerns about proposed regulations for Inflation Reduction Act (IRA) tax credits for new and pre-owned clean vehicles and proposed regulations to enforce IRA provisions restricting the influence and materials of “foreign entities of concern”, or FEOCs – particularly Chinese entities – in order to reduce their role in the U.S. battery supply chain.

In attendance was SMI analyst Ben McNutt, who reports on the major takeaways:

The same page: Participants broadly agreed on the need to lower costs for consumers to get more electric vehicles on the road as a step towards tackling the climate crisis. The EV tax credits, and their implementation in the upcoming final rules, will have a big role to play in making EVs attractive for auto manufacturers and consumers alike.

Transition tussle: Auto manufacturers advocated for extending the proposed “non-traceable battery materials” transition rule past 2026, which would allow them to keep using certain materials including electrolyte salts, additives and binders sourced from foreign entities of concern such as China. But U.S. battery and battery material companies meanwhile opposed extending or expanding the transition rule, arguing it strengthened China’s grip on the battery supply chain and that relevant materials were easily traceable.

Tight control: Environmental groups and U.S. companies making battery components asked the IRS and Treasury Department to enforce strict interpretations of FEOCs and ensure proper due diligence. They argued that keeping Chinese inputs out of the U.S. battery supply chain would be in the best interest of environmental, human rights, and national security goals.

Papers, please: Environmental groups advocated for a “battery passport” similar to one in place in the European Union to ensure compliance with battery sourcing requirements. EV and consumer advocates also asked the IRS and Treasury to create an online tool or seal to help consumers identify which dealers qualify for IRA tax credits on their electric vehicles.

LIFE SCIENCES

‘WE CAN REBUILD HIM’: Go inside the world’s most advanced bionics lab with “The Hacksmith,” who as far as we can tell has the only outfit making light sabers, Captain America’s shield, Thor’s hammers, and Wolverine’s claws.

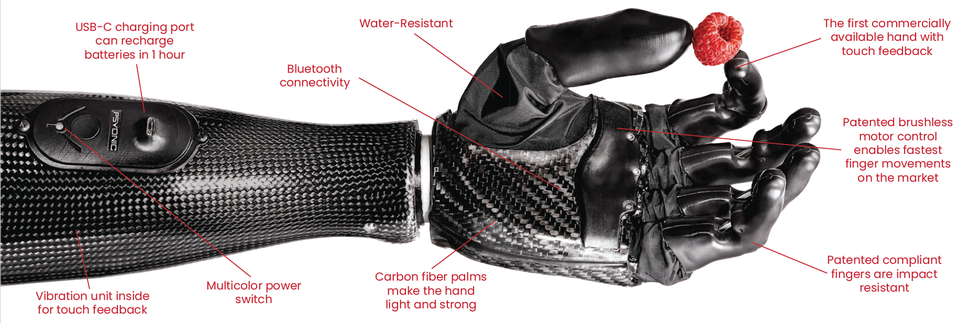

Engineer and tech influencer James Hobson, who’s Hacksmith Industries is turning sci-fi into working prototypes, visited SMI client PSYONIC, which is developing the most advanced bionic limbs and making them more accessible than ever.

The Ability Hand, described as “lightweight, robust, touch-sensing & covered by Medicare.,” is available now.

Psyonic is currently developing a bone-integrated version of the Ability Hand that is controlled with neural implants and has longer term plans to develop other limbs, including legs and full arms.

CLIENTS IN THE NEWS

America’s Carriers Rely on Chinese Chips, Our Depleted Munitions Too.