Welcome to the November edition of A Capitol View

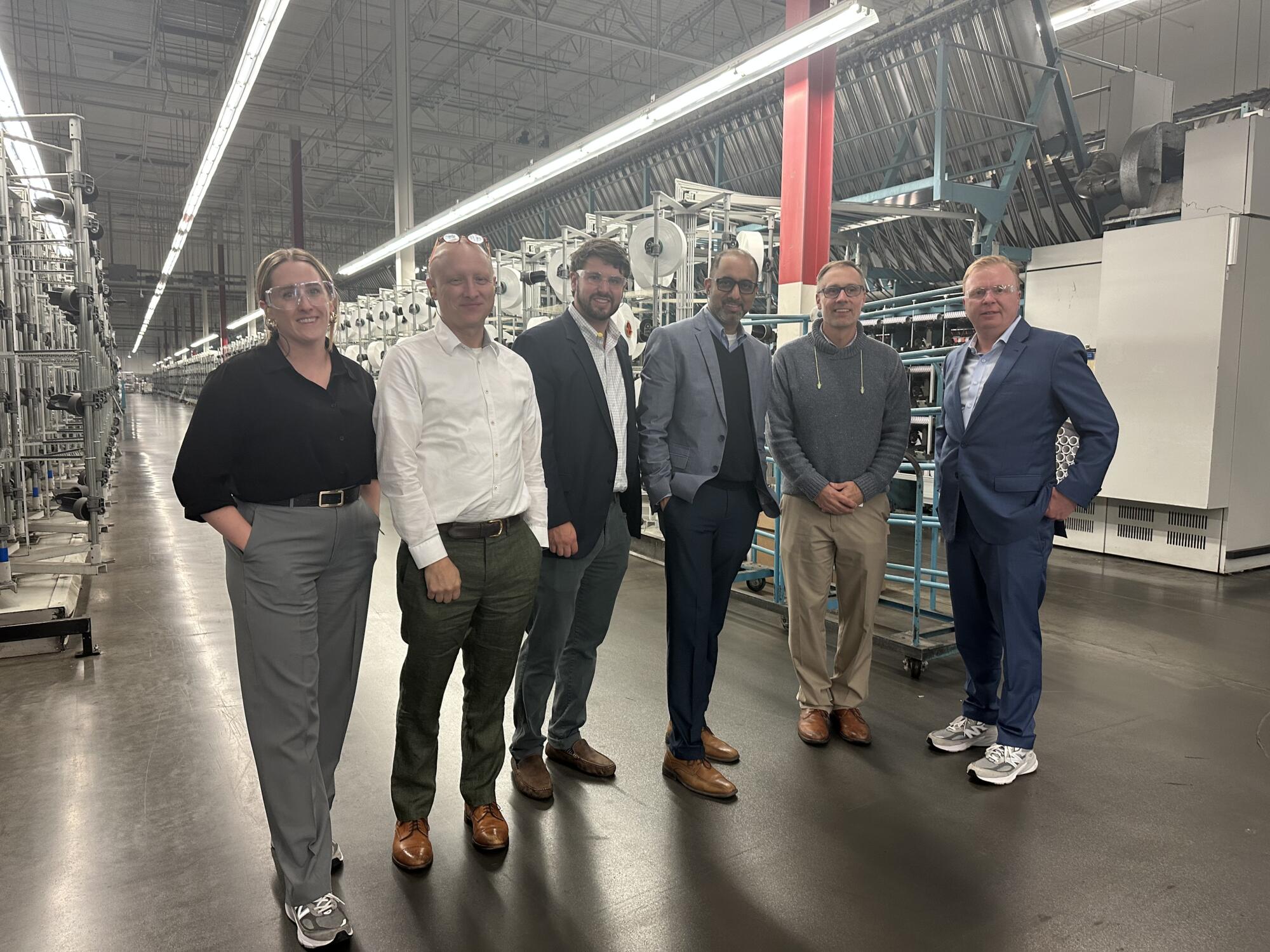

The United States Footwear Manufacturers Association fall meeting was hosted by SMI and Unifi Manufacturing in North Carolina, where more than three dozen reps from the leading domestic footwear manufacturers and suppliers plotted the expanding trade group’s ambitious policy agenda in Washington.

A special thanks to Jon Bosworth, chief of staff for Rep. Earl Blumenauer (OR), the top Democrat and former chair of a member of the House Ways and Means Trade Subcommittee, who provided an insider update on legislative priorities on Capitol Hill, and Nick Halmrast, regional representative for Sen. Thom Tillis (R-NC), for also joining the meeting.

Attendees got to tour new member Karl Mayer’s Stoll Showroom in Greensboro and Unifi’s state-of-the-art REPREVE Manufacturing Facility in Yadkinville.

Over the past year, USFMA has welcomed new members KX Lab; Orisol; Drexel University; Worthen; COMMUNITYmade; and Draper Knitting. In addition, the two-day gathering drew reps from members BASF; New Balance; Bixby; Dela; Haartz; Kamik; Meramec; Okabashi; PolyLabs; Precision Testing Labs; Roger Foams Corporation; Rubberlite; Signet Mills; UMASS Lowell.

Policy priorities: USFMA is pursuing an aggressive policy agenda to ensure trade and tax policies advance domestic footwear manufacturers.

It is advocating for the Import and Security Fairness Act, introduced by Rep. Blumenauer, to prevent businesses from exploiting import loopholes that could harm domestic industries. And it is tracking The Americas Act intended to increase supply chain investments in the Western Hemisphere to ensure it doesn’t harm domestic manufacturing.

On tax policy, USFMA has also joined a broad coalition of businesses and trade associations calling on Congress to pass The American Innovation and R&D Competitiveness Act that would restore the ability to deduct research and development expenses in the year they are incurred.

“Currently, companies are forced to amortize research and development over five years,” SMI CEO and USFMA Executive Director McCann wrote to Rep. Jason Smith (MO), the Republican chair of the House Ways and Means Committee, on Oct. 19. “This is a practice that can unintentionally hinder advancements in innovation and delay investments.”

Military matters: Member companies also discussed efforts to ensure proposed language in the fiscal 2024 National Defense Authorization Act is adopted seeking an assessment of current policy that allows military servicemembers to wear foreign-made boots on duty – a major loophole to the Berry Amendment that mandated US-made footwear. USFMA, meanwhile, is also advocating that the U.S. Army test whether it should make dedicated boots for female soldiers, rather than rely on unisex form, fit, and function.

USFMA is planning a full-scale push next year to ensure that the military branches and U.S. Coast Guard require Berry Amendment-compliant boots and dress shoes for servicemembers on duty.

“USFMA is working to make sure we are using this moment to support domestic footwear manufacturing which produces the highest quality products for consumers and our service members in the military,” said SMI Director and USFMA Trade Policy Director Karlee Popken. “All members, from manufacturers to suppliers to higher education institutions, are committed to revitalizing the domestic footwear industry. USFMA is ensuring our nation’s trade policy and tax code are working to promote American-made products.”

Why join? Membership offers companies and universities in the domestic footwear pipeline an active forum for information exchange, innovation, collaboration, and networking. It is also the epicenter for military footwear R&D, pursuing appropriations from Congress, and leading industry-wide campaigns to grow domestic manufacturing of footwear through fair trade, strong manufacturing policies, and programs that strengthen the supplier base.

SMI SPOTLIGHT

A SEASONED LEADER: We are pleased to welcome to the SMI team as Senior Director John Major, a seasoned leader in manufacturing and product development who will help strengthen the firm’s military portfolio.

He began his career at Ford Motor Company before joining Navistar, where he led the Mine Resistant Ambush Protected (MRAP) program that swiftly delivered over 6,200 armored personnel carriers to U.S. troops under fire in Iraq and Afghanistan.

Following Navistar, Major was the COO at Plasan US, which produced survivability products for the military. He is also a former VP for government relations at Achates Power, where he helped secure over $35 million in congressional ads to develop a new Army combat vehicle engine.

Key relationships: Most recently, he was VP for Manufacturing and Programs at Carbon Robotics and is co-founder of Comprehensive Carbon Impact, which advises the Army on commercial technology investments, tech transition, and advanced manufacturing methods.

Much of John’s career has been at the intersection of industry supporting our nation’s military with the full support of Congress,” said SMI CEO Bill McCann. “At SMI, he will support a number of our current clients and will work to build a strong Army and DoD ground vehicle client portfolio.

“John has excellent relationships with leadership at the Army Ground Vehicle Systems Center and at the Tank-Automotive & Armaments Command, as well as with many of the Midwest congressional delegations,” Bill added.

Said John: “SMI helped me secure over $60 million in DoD and DOE funds for three different companies while I was on the industry side, and I am thrilled to bring that joint track record of success for our clients.”

John holds a BA and master’s degrees in mechanical engineering from the University of Illinois.

BUDGET

‘WHITE KNUCKLED MADNESS’: We culled a few of our leading budget watchers for some tea leaf reading under the new leadership of House Speaker Mike Johnson.

“White knuckled madness,” is how SMI VP Bill Berl, a defense industry and House appropriations veteran, put it. “Different speaker, same push for conservative policy positions that will result in crisis negotiations and possible shutdown.”

“Speaker Johnson will quickly learn that changing funding agreements and writing legislation takes time, and that is something Washington has less of than money, and time can’t be offset,” added SMI VP Maria Bowie, a veteran of Capitol Hill budget battles.

She also thinks that the curbs placed on federal spending earlier this year are in jeopardy. “Funding levels lower than the bipartisan June agreement will not survive the Senate,” she predicted.

First things first: How Congress handles President Joe Biden’s proposed $106 billion supplemental budget request for Ukraine, Israel, and border security measures could preview how the annual budget process will go, said SMI Senior VP Jeremy Steslicki, a former top Senate aide.

“The defense supplemental legislative process will be informative and predictive of the regular appropriations dynamic,” he said. “The current House GOP approach is dead on arrival in the Senate, with bipartisan opposition. Will the Speaker learn from this or let the minority of the GOP caucus continue to bang his head into a brick wall? If it’s the latter, we are in for a very nervy time.”

‘A solid member’: SMI CEO Bill McCann sounded more optimistic that Johnson can negotiate a deal for at least a continuing resolution that locks in spending at current levels and fully resources national security.

“While much of media coverage on Speaker Johnson has focused on his social conservatism, it’s important to remember that he’s been a solid member of the House Armed Services Committee since coming to Congress in 2017,” he said.

“It’s not going to be easy, and we still are learning about how he will manage the House,” Bill added. “But right now, the speaker has a great deal of political capital, enough in my opinion to pass ‘cleanish’ CR and wrap up the FY24 appropriations process by the end of the calendar year. “He’s certainly been supportive of a strong national defense and has gone to bat for Louisiana constituents in both the defense authorization and appropriations process.”

Just in: Powerful Granger not running again for Congress, via Fort Worth Report.

ENERGY

‘A CROSSROADS’: SMI has been leading the charge in securing greater federal investments and developing industry partnerships to help transition the most promising waterpower technologies.

SMI VP Jeff Leahey attended the National Hydropower Association’s annual Clean Currents in Cincinnati, dedicated to clean, reliable, affordable energy derived from water-based resources.

Leahey, a member of the NHA board of directors, assisted several clients in engaging with the Department of Energy’s Water Power Technologies Office, the Grid Deployment Office, and the Loan Programs Office, and he arranged a series of business-to-business networking meetings and introductions.

VP Paul Gay, co-chair of the National Hydropower Association’s Marine Energy Council, traveled to The Hague for the Ocean Energy Europe annual conference to huddle with universities, research centers, government agencies, and technology developers working to commercialize wave, tidal, ocean current, and riverine renewable energy systems.

The SMI waterpower team – including senior VP Damian Kunko – has decades of combined lobbying and federal marketing experience helping companies secure federal investments for their commercialization pathways, including navigating new tax benefits under the Inflation Reduction Act, grant applications through Bipartisan Infrastructure Law, and securing additional funds for research and development.

The big picture: Marine energy technologies are undergoing rapid innovation, but the U.S. has fallen behind global competitors. The European Union and UK are making large public investments and without increased investment, the U.S. will become an importer of these renewable energy systems.

The Biden Administration proposed a 13 percent cut for marine energy in its FY 2024 budget proposal, Paul noted. “We have worked hard since then to block that proposed cut and instead secure an increase in funding.”

“There is excitement for the future of waterpower,” said Jeff. “Unprecedented levels of federal support for the industry will lead to greater deployment opportunities, benefits to local communities, and jobs.”

TRADE

PROS AND CONS: SMI is tracking the fallout of China’s announcement that it is imposing new export controls beginning Dec. 1 on graphite, which could accelerate the U.S. transition to independent electric vehicle production but also means critical minerals, materials, and metals now face increased production costs.

China is the world leader in graphite, a vital component in battery anodes and nuclear reactors, and most EV manufacturers in the U.S. and Europe are dependent on them.

“What China is saying to the West with this decision is that we are not going to help you make electric cars, you have to find your own way to do that,” Northern Graphite CEO Hugues Jacquemin told Reuters.

The mining industry and its supporters have been lobbying for greater U.S. production of critical materials like graphite, but the permit review process for mining on public lands is tedious and lengthy.

The Biden administration recently released a report detailing improvements for mining within the U.S., in line with domestic critical mineral and materials goals.

Related: EU, US to keep talking about tariffs as war in Israel and Ukraine overshadow talks, via Reuters.

TECHNOLOGY

Common Approach: SMI Director Aarzu Maknojia was on hand for the inaugural Microelectronics Commons meeting outlining the strategy for the national prototyping network of eight hubs recently selected by the Department of Defense. Among our clients participating in the regional consortia are 3D Glass Solutions, Samtec, and the University of Michigan.

What to expect: Aarzu reports that the government will release a request for topics in the third quarter of each fiscal year, followed by a request for projects in the first quarter of the following year. Any entity can submit a topic through a hub, and hubs will not be able to curate or edit the responses before forwarding them to the government. A request for projects for the first year is expected in Q1 of next year.

STRATEGIC COMMUNICATIONS

THOUGHT LEADERSHIP: SMI VP for Communications Strategy Bryan Bender kicked off the final day of the American Institute for Aeronautics and Astronautics’ ASCEND conference in Las Vegas with a panel discussion titled “What Has Space Done for Me Lately?”

The discussion included diverse perspectives on how space companies can sharpen their narrative to ensure policymakers and the public are invested in military, civil, and commercial projects to build and defend a cislunar economy between the Earth and the moon.

Strategy session: Bryan also participated in AIAA’s inaugural Space Marketing Communications Leadership Exchange.

The private session brought together leading communicators from Lockheed Martin; Boeing; Microsoft; Hewlett Packard Enterprise; Astroscale; Griffin Communications Group; Blue Origin; SpinLaunch; MTN; The Aerospace Corporation; Cro Metrics; Gravitics Inc.; VAST; Redwire Space; and the International Space Station National Laboratory.

ON THE MENU: SMI will host an exclusive salon dinner this month at its DC offices focused on the space industrial base and how to narrow the divide between the federal government and the commercial space industry to ensure the U.S. stays ahead of potential adversaries.

On hand will be leaders from the Space Force, industry executives, trade association reps, and other thought leaders from the think tank community and media sector.

The series, moderated by Bryan, is part of the communications practice’s efforts to help clients educate key decision-makers about their products and expertise and serve as an incubator of best practices for public-private partnerships.

CLIENTS IN THE NEWS

Codagenix Inc. is among the first firms to be selected for Covid-19 nasal vaccine trials, via Department of Health and Human Services.