Welcome to the August edition of A Capitol View

The Small Business Innovation Research has been the most successful government effort to seed next-generation technologies, from start-ups and other small innovators. And the Biden administration and Congress are seeking to double down.

They are pursuing additional ways to strengthen the competitive awards as part of broader efforts to bring new, more nimble players into government contracting and reduce some of the bureaucratic barriers that often scare off companies and venture capitalists.

President Biden’s fresh executive order on domestic manufacturing highlights the program as a key tool in accelerating innovation, directing a more “coordinated interagency approach to innovation and research solicitations with the goals of reducing barriers to program participation, streamlining access to funding opportunities, and encouraging the production of new technologies in the United States.”

Congress is also debating new measures as part of the fiscal 2024 National Defense Authorization Act to strengthen the process with more flexible contracting rules and funding sources to help transition the most promising technologies across the so-called “valley of death” to troops, federal agencies, and commercial applications.

House action: The House has been focusing on making it easier for venture capital to get SBIR funds, says SMI Director Karlee Popken, who has been tracking the legislative action. Its version of the NDAA extends the Domestic Investment Pilot Program that makes companies with venture capital majority ownership eligible for SBIR funds.

Senate action: The Senate version, meanwhile, extends a pilot program aimed at streamlining technology transition from SBIR and related Small Business Technology Transfer program.

It also includes the Investing in American Defense Technologies Act, which “would establish a public-private partnership to scale, support, and invest in defense-centric small businesses that produce advanced capabilities such as hypersonic, space, and autonomous systems,” Popken says.

The proposed Senate NDAA also requires annual Pentagon reports on the SBIR program.

TICKING TIME BOMB: A new coalition, Americans for Innovation, is trying to convince Congress to swiftly reverse a recent tax law reform that requires companies to deduct R&D costs over five years instead of annually. The so-called Section 174 provision is seen as particularly harmful to small businesses facing a tax burden tidal wave.

“Recent changes to the law penalize companies who invest in innovation, harming everyone — consumers, employees, and businesses — especially and disproportionately smaller businesses in every industry,” their appeal states. “Congress has a narrow window to fix this bomb before it explodes and catalyzes significant economic hardship that will ripple across all social classes.”

Taking action: Organizer Dr. Michael Blackstone, CEO of Suture Health, said the group is developing a proposal for an emergency exemption for small businesses by Sept. 15. At the same time, he said, “We’re teaming up with one or more partner banks to launch an exclusive loan program for members, providing further resources to support your innovation efforts. More: Warren slams defense contractors over tax lobbying, via Defense News.

For your radar: Defense Logistics Agency to hold R&D industry day on Sept. 11, via DLA.

DEFENSE

HYPERACTIVE: The race to beat China in hypersonic weapons depends heavily on a robust domestic industrial base. And the Pentagon is empowering an Innovation Capability and Modernization team “to bring novel technologies, new manufacturing capabilities, and industrial modernization to strengthen the competitive posture” of the industrial base.

“Recent advances in hypersonic technologies by potential adversaries have seen numerous successful tests of hypersonic weapons,” states a new request for information. “The focus of the ICAM team is to improve hypersonics supply chain technologies, to reduce costs, increase manufacturing capacity, and bring disruptive technologies to address critical gaps impeding production advancements.”

Focus areas: The effort is emphasizing thermal protection systems; scramjet engines; additive manufacturing; cables and wiring; glide body subsystems and integration; and forgings and castings.

“The expectation of these investments,” the industry request adds, “is to improve some combination of capacity, performance, and major cost reduction of critical hypersonic subsystems.”

BUDGET WARS: The Senate Appropriations Committee overwhelmingly approved a $831 billion Pentagon funding bill, as Congress plods toward a final, bipartisan package this fall of annual spending and policy bills. Highlights include congressional plus-up spending beyond the debt ceiling agreement, significant cuts to industrial base policy programs such as DPA Title III and IBAS, and support for AUKUS.

Extra, extra: The proposal includes an additional $8 billion in emergency spending to bolster military readiness, address the impact of inflation on acquisition costs, finance weapons for Taiwan, and to strengthen industrial base capacity.

Ukraine fight looms: Defense Appropriations Chair Jon Tester (D-Mont.) also said he expects President Joe Biden to seek separate funds to aid Ukraine.

There appears to be a strong bipartisan consensus in the Democratic-led upper chamber to keep supporting Kyiv as it fends off the Russian invasion. Members from both parties are calling for nearly $14 billion in additional defense spending to bolster Ukraine, backfill munitions stockpiles, and boost efforts to counter China.

But many questions remain on how a proposal for more Ukraine aid will fare in the House. Speaker Kevin McCarthy has expressed reluctance to further increase deficit spending and must navigate the demands of fiscal hardliners within the GOP conference who have seriously questioned further military assistance.

Policy disagreements, too: The full Senate passed its annual Pentagon policy bill, authorizing $886 billion for national defense in fiscal year 2024. It includes a 5.2 percent pay raise for service members, assistance for Ukraine, and support for helping outfit Australia with Virginia Class submarines in the 2030s under the AUKUS agreement.

It sets up a clash with the GOP-controlled House, which in its version of the NDAA approved a series of divisive provisions on abortion, transgender troops, and diversity training.

Upcoming negotiations to craft a final National Defense Authorization Act are complicated by other major disagreements. For example, the House proposed a dedicated inspector general to exert greater oversight of Ukraine assistance and included the removal of various climate-focused programs.

What’s next: Senate Majority Leader Chuck Schumer is calling for action on government funding and policy bills, but progress is expected to be delayed until the Senate returns from its summer recess in September.

Read up: FY2024 NDAA: Summary of Funding Authorizations, via Congressional Research Service.

And: FY2024 NDAA: Status of Legislative Activity, via CRS.

Plus: Statement of administration policy on Senate NDAA, via White House.

SHIPBUILDING

SHIP SHAPE: The Defense Department has issued a final rule that requires shipbuilding components only to be procured from manufacturers within the National Technology and Industrial Base, which includes the United States, Australia, Canada, the United Kingdom, and New Zealand.

What’s covered: The components include gyrocompasses, electronic navigation chart systems, steering controls, pumps, propulsion and machinery control systems, totally enclosed lifeboats, and large medium-speed diesel engines for new construction of auxiliary ships financed by the National Defense Sealift Fund programs or the Navy’s shipbuilding and conversion budget.

Sen. Tammy Baldwin (D-WI) has also included an amendment in the Senate version of the NDAA that would require all new Navy ships to use 100 percent domestically produced materials by 2033.

TECHNOLOGY

LINKING UP – The Defense and Commerce Departments have inked an agreement to strengthen the implementation of the CHIPS and Science Act

The memorandum of understanding aims to better align the agencies’ priorities as they make major investments in investments in expanding and making more resilient the domestic semiconductor supply chain.

The agreement “is a good step towards ensuring that this once-in-a-generation investment is spent as efficiently and effectively as possible,” said SMI Director Aarzu Maknojia. “While the $52.7 billion package passed by Congress nearly a year ago is a great step, the United States must still compete with the funding and head start our near-peer adversaries have. I hope this MOU will increase collaboration, minimize duplicative efforts, and maximize impact overall.”

LIFE SCIENCES

Congress is moving toward reauthorizing the Pandemic and All-Hazards Preparedness Act, which provides essential authorities to respond to public health emergencies and other crises but expires Sept. 30. But don’t count on it happening before the deadline.

In the House: The Republican-led House Energy and Commerce Committee voted mostly along party lines to renew the legislation. It adopted amendments related to drug shortages that would increase readiness and response time, improve federal planning methods, and strengthen biosecurity.

In the Senate: Meanwhile, the Senate Health, Education, Labor, and Pensions Committee overwhelmingly passed its own version. Despite disagreements over specific provisions, lawmakers seem eager to make reauthorization a priority given the need to effectively respond to public health emergencies, biological threats, and other all-hazard situations.

Logjam: But the different bills have a long way to go before being reconciled into a final version that both can get through both chambers, says SMI Director Evan Dormer, who is tracking the deliberations. “With two competing proposals with vast legislative space between the two It is unlikely that a new PAHPA is reauthorized before the current one expires,” he said.

Moreover, the agenda is filling up quickly. “This is all also happening as Appropriations, the NDAA, and the Farm Bill all must pass and still have an unclear path.”

ENERGY

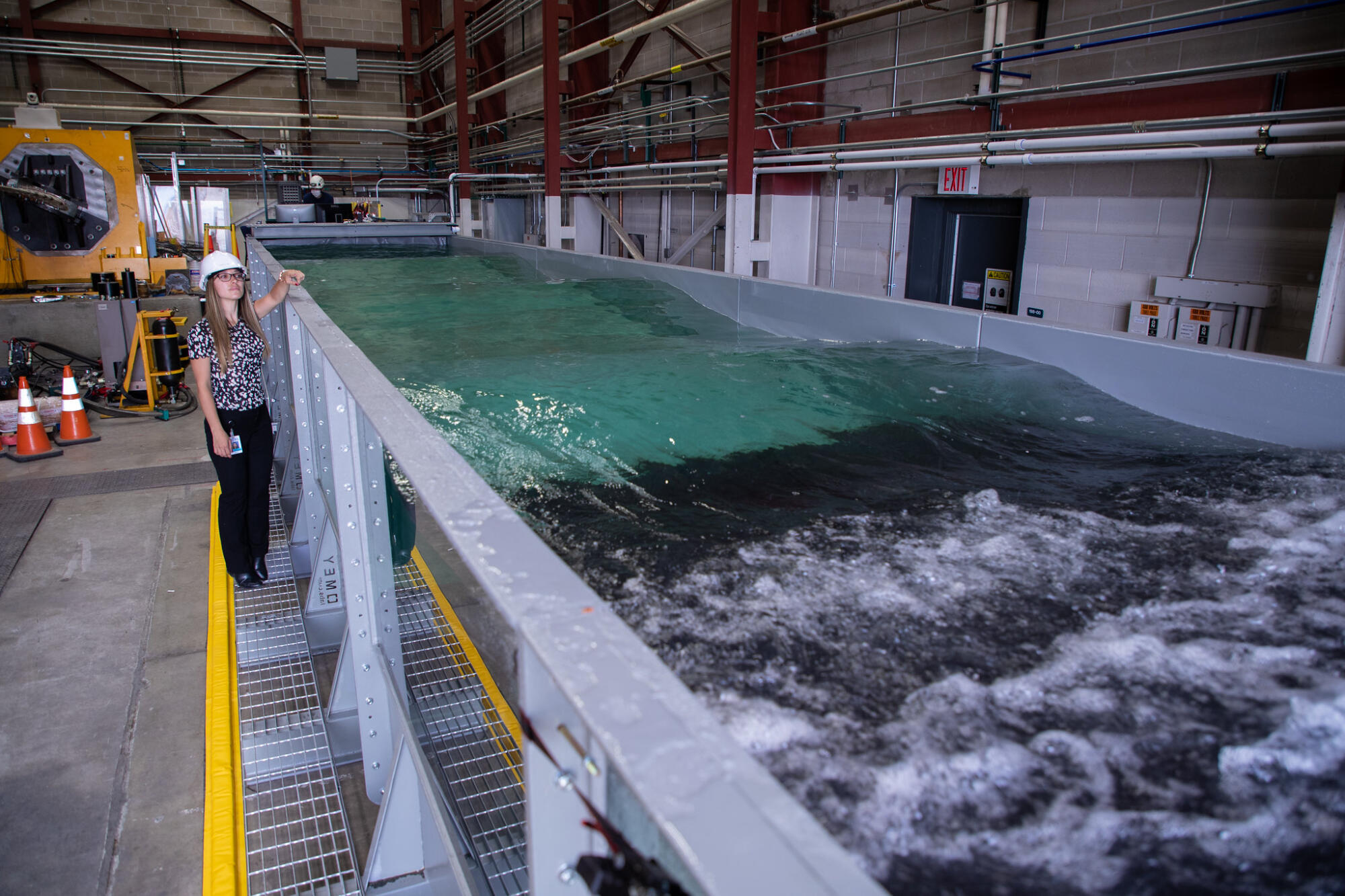

SURF’S UP: Department of Energy has made its “first significant investment in marine energy” with a $10 million investment in seven innovative projects, including $800,000 for SMI client Florida Atlantic University’s U.S. Ocean Current Marine Energy Test Facility Feasibility Assessment.

The project will assess the feasibility of establishing an ocean current test facility off the coast of Palm Beach County, Florida, that connects marine energy to the grid and can accelerate commercial applications.

The assessment will analyze infrastructure needs and coordination with regulatory agencies in order to develop an initial regulatory and permitting roadmap, DOE said.

Why it matters: “Tapping ocean currents like the Gulf Stream to power our communities and economy is one of the most immediately viable cutting-edge renewable energy opportunities because it is abundant and available 24/7,” says SMI Senior VP Damian Kunko.

Florida Atlantic University’s Southeast National Marine Renewable Energy Center, he added, “is poised to offer the world’s leading turbine tow testing capability, grid connection, and long-term moorings for marine energy technology developers.”

MINE THE GAP: DOE’s Office of Fossil Energy and Carbon Management has issued a notice of intent it plans to fund new R&D projects that promote domestic production and recycling of critical minerals and materials that are vital to clean energy technologies, including solar panels, wind turbines, electric vehicles, and hydrogen fuel cells.

“Applicants will be required to carefully consider impacts and benefits to workers and communities by emphasizing community and labor engagement, the creation of high-quality jobs, and avoiding the imposition of additional burdens on affected communities through the implementation of the Justice40 initiative,” according to the announcement, referring to efforts to prioritize climate projects that benefit disadvantaged communities.

Read up on what DOE is looking for.

More energy news: One-year-old, US climate law is already turbocharging clean energy technology, via Associated Press.

CLIENTS IN THE NEWS

New Balance plans a new factory in Londonderry, via Union Leader.

LiquidPiston unveils new facility, plans additional hiring, via The Middletown Press.

New data shines brighter light on merits, impacts of SBIR, STTR programs, via Federal News Network.