SMI Expands into New Space

SMI recently moved to a new office building at 200 Massachusetts Ave NW in Washington, DC. Though the firm enjoyed its time just off of K Street for nearly 25 years, corporate growth and close proximity to Capitol Hill and other federal buildings made this new space an excellent fit for SMI’s future. With brand-new facilities, a state-of-the-art conference center, and an impressive rooftop, we look forward to hosting guests in the new year! See some photos of our new space below:

SMI Welcomes Karlee Popken as Director

SMI is pleased to announce that Karlee Popken has joined the firm as a Director. Karlee is a seasoned legislative and public policy professional with expertise in appropriations, housing and community development, social welfare, tax and finance, and trade and economic policy. At SMI, Karlee will support a wide range of client activity including the firm’s strong presence in the New England region.

“Karlee is going to hit the ground running with our current and future clients,” said SMI President Bill McCann. “She knows how the appropriations and authorization process works. She was also right in the middle of SBIR reauthorization. We are thrilled to have her join our team.”

“I am excited to bring the skills I have gained over the past six years on the Hill to SMI and to help clients accomplish their policy and funding goals,” said Karlee Popken. “SMI has an extensive track record of delivering appropriation wins to clients and I am thrilled to be joining such an accomplished team.”

Most recently, Karlee served as a Legislative Assistant to Senator Ed Markey, where she led the office’s appropriations process and supported the Senator’s assignment on the Senate Small Business & Entrepreneurship Committee. Previously, Karlee served as a Legislative Correspondent for then-Senator Bill Nelson, the current NASA Administrator. Prior to Capitol Hill, Karlee worked as a Policy Advisor to the Irish Legislature and as a Teacher at the Esperanza Academy in Lawrence, MA

Karlee holds an MPP from the University College Dublin and a BA in Political Science and Government and Women and Gender Studies from the College of the Holy Cross.

What’s Going on in Congress? | FY23 Appropriations and Authorizations

FY23 Appropriations Bill Passed and Signed into Law

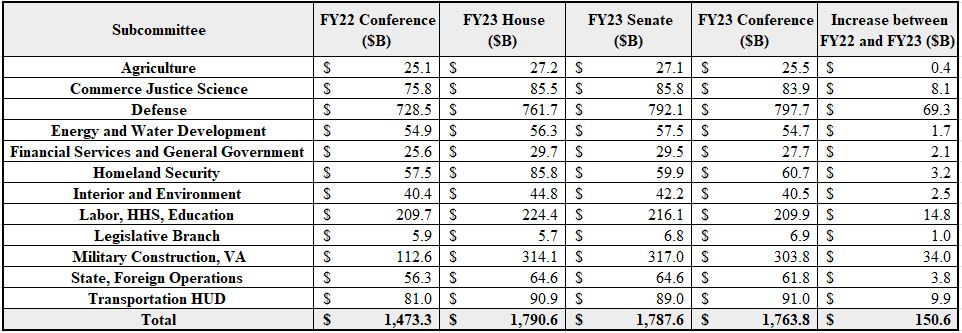

On December 29, President Biden signed the FY23 omnibus appropriations bill, which totaled $1.7 trillion. House and Senate leaders made a strong push to avoid a government shutdown and pass the budget ahead of the holidays. The Senate passed it by a margin of 68-29 and the House 225-201. The final bill contains $858 billion for national defense, $772 billion for domestic programs, $45 billion for aid to Ukraine, and $40 billion in disaster relief. Below is a breakdown of the discretionary spending from all 12 bills.

The National Defense Authorization Act Passed and Signed into Law

On December 23, the same day President Biden signed the omnibus bill, he also signed the FY2023 National Defense Authorization Act (NDAA) into law, authorizing $817 billion for the Department of Defense, $45 billion more than what was requested in the President’s Budget Request (PBR). The NDAA authorizes $12.6 billion to mitigate the impact of inflation on purchases and $3.8 billion to mitigate the impact of inflation on military construction. The NDAA authorizes an increase in air and land warfare capabilities, cybersecurity, pay, and benefits for military personnel and eliminates the military’s Covid-19 vaccine mandate.

SMI’s team of analysts will release an in-depth summary of major procurement and research, development, test, and evaluation (RDT&E) provisions to provide insights and analysis on congressional proprieties within the next month.

DOE Announces Major Nuclear Fusion Breakthrough

In December, the Department of Energy (DOE) and National Nuclear Security Administration (NNSA) announced that they achieved Nuclear Fusion ignition at the Lawrence Livermore National Laboratory (LLNL), a breakthrough in energy science. On December 5, LLNL’s National Ignition Facility (NIF) conducted the first controlled fusion experiment in history to achieve net-energy production, paving the way for continued breakthroughs in this space. Nuclear Fusion combines atoms, whereas Nuclear Fission, the current technology used in nuclear reactors, splits atoms. There are many benefits to using Fusion over Fission, but the primary motivation for achieving Nuclear Fusion at scale is the potential for unlimited clean energy that does not transmit radiation.

In December, the Department of Energy (DOE) and National Nuclear Security Administration (NNSA) announced that they achieved Nuclear Fusion ignition at the Lawrence Livermore National Laboratory (LLNL), a breakthrough in energy science. On December 5, LLNL’s National Ignition Facility (NIF) conducted the first controlled fusion experiment in history to achieve net-energy production, paving the way for continued breakthroughs in this space. Nuclear Fusion combines atoms, whereas Nuclear Fission, the current technology used in nuclear reactors, splits atoms. There are many benefits to using Fusion over Fission, but the primary motivation for achieving Nuclear Fusion at scale is the potential for unlimited clean energy that does not transmit radiation.

“This is a landmark achievement for the researchers and staff at the National Ignition Facility who have dedicated their careers to seeing fusion ignition become a reality, and this milestone will undoubtedly spark even more discovery,” said US Secretary of Energy Jennifer Granholm.

Updates on CHIPS and Science Act Funding

![]() Over the past few weeks, the National Institute of Standards and Technology (NIST) has released key updates and guidance on the implementation of several semiconductor R&D programs that received $11 billion under the CHIPS and Science Act. NIST intends to develop the project and program framework using input received through Requests for Information (RFI) and Stakeholder Roundtables. In addition to the R&D efforts funded through the NIST, the Department of Defense (DoD) has issued a final Request for Solutions (RFS) for the CHIPS for American Defense Fund, which will support the DoD’s Microelectronics Commons Program.

Over the past few weeks, the National Institute of Standards and Technology (NIST) has released key updates and guidance on the implementation of several semiconductor R&D programs that received $11 billion under the CHIPS and Science Act. NIST intends to develop the project and program framework using input received through Requests for Information (RFI) and Stakeholder Roundtables. In addition to the R&D efforts funded through the NIST, the Department of Defense (DoD) has issued a final Request for Solutions (RFS) for the CHIPS for American Defense Fund, which will support the DoD’s Microelectronics Commons Program.

Inflation Reduction Act Updates from the Treasury Department

On December 15, the White House released an official guidebook for the implementation of over 135 programs and funding opportunities provided through the Inflation Reduction Act (IRA). Published on the newly created cleanenergy.gov site, the guidebook will serve as a living document for all updates related to the rollout of clean energy, climate mitigation and resilience, agriculture, and conservation-related tax incentives and investment programs.

On December 15, the White House released an official guidebook for the implementation of over 135 programs and funding opportunities provided through the Inflation Reduction Act (IRA). Published on the newly created cleanenergy.gov site, the guidebook will serve as a living document for all updates related to the rollout of clean energy, climate mitigation and resilience, agriculture, and conservation-related tax incentives and investment programs.

White House Inflation Reduction Act Guidebook

In addition to the guidance provided through the White House guidebook, the Treasury Department and IRS have continued to release updates and guidance on the implementation of tax credits funded through the IRA, including incentives for the manufacturing, sale, and purchase of clean vehicles.