Welcome to the April edition of A Capitol View

SMI’s energy and defense teams are firing on all pistons as the Biden Administration continues to disperse historic levels of funding approved by bipartisan majorities in Congress to strengthen domestic supply chains and produce materials here at home that are critical for national security.

SMI client MP Materials secured a $58.5 million award under new clean energy tax credits to support construction of the nation’s first fully integrated rare earth magnet manufacturing facility in Fort Worth, Texas.

A key component: The company will produce Neodymium-iron-boron (NdFeB) magnets, which are indispensable in the electric motors and generators that power hybrid and electric vehicles, robots, wind turbines, drones, electronics, and critical defense systems.

The Section 48C Advanced Energy Project tax credit administered by the Department of Energy was issued by the Internal Revenue Service and Department of Treasury after assessing 250 projects for technical and commercial viability and environmental and community impact.

Kicking the habit: Currently, 90 percent of the world’s NdFeB magnets are produced in China and the Department of Commerce says that the United States is “essentially one hundred percent dependent on imports” for the components it calls “irreplaceable in key defense applications.”

The raw materials will come from MP Materials’ mine in Mountain Pass, California, the country’s only scaled and operational rare earth mine and separations facility.

Digging in: MP Materials expects production of precursor materials to begin this summer and finished magnets by late 2025. MP will supply the magnets to General Motors to support its North American EV production.

Special shoutout to SMI’s energy team, including Samm Gillard, Tas Ingram, and Jeff Leahey, for helping turn concept into capability.

Viewpoint: Biden’s EPA can justify his new EV rules only by cooking the books

Counterpoint: Biden’s new EV rules don’t go fast enough for the climate crisis

SMI SPOTLIGHT

STANDING OUT: Bloomberg Government published its annual analysis of top performing lobby firms and SMI has once again been ranked as a “standout.”

“Those firms retained 80% or more of their clients from the preceding year and 60% percent of more of their clients over the past three consecutive calendar years,” according to the analysis. “They also posted figures showing revenue-per-lobbyist of $550,000 or more.”

Read more about the analysis: Bloomberg Government Releases 9th Annual Top-Performing Lobbying Firms Report, Unveiling Insights into Record-Breaking Federal Lobbying Expenditures

CONGRESS

SEASON’S GREETINGS: The congressional calendar is filling up as deliberations begin for the fiscal 2025 budget process and other annual bills such as the National Defense Authorization Act that set policy.

SEASON’S GREETINGS: The congressional calendar is filling up as deliberations begin for the fiscal 2025 budget process and other annual bills such as the National Defense Authorization Act that set policy.

Markups: It looks like the House Armed Services Committee plans to craft its version of the NDAA in mid-May, followed by the Senate Armed Services Committee in mid-June.

As for appropriations, military leaders and other executive branch leaders have started presenting their budget priorities before oversight panels in both chambers. And SMI has spent the spring in a full court press on behalf of clients, with meetings and briefings for lawmakers and staff and executive branch officials on the gamut of funding and policy priorities.

Where we are: Congress finally passed FY24 appropriations in March, including $824.3 billion for the Department of Defense, which was $26.8 billion more than last year.

What’s in the offing: For the new fiscal year that starts Oct. 1, DoD is seeking about $850 billion, which is within the confines of a two-year congressional budget deal. That includes $167.5 billion for procurement and $143.2 billion for research, development, test and evaluation.

Ukraine aid: But congressional dysfunction continues to hold up much-needed military aid for Ukraine, even as its hard-fought battlefield gains since Russia’s invasion two years ago are being erased.

Don’t forget the jobs: The assistance is part of a $95 billion package, of which $50 billion would be directly invested in the U.S. defense industrial base.

“And I would remind everyone that the military doesn’t give Ukraine money, it provides security assistance in the form of weapons and munitions, and we replace those weapons and munitions by buying new weapons ammunition for our inventory and that flows through our industrial base,” Defense Secretary Lloyd Austin told the Senate Armed Services Committee on April 9. “Some $50 billion of this request would flow through our industrial base and it would create good jobs for Americans in some 30 states.”

Opinion: Congress’s Moment of Truth on Ukraine Aid

NOW OR NEVER? GOP opposition in the Senate appears to be softening to a tax package that would restore the ability of companies to write off R&D expenditures annually instead of spreading them out over five years, The Washington Post reported.

‘Sign of possible momentum’: “In a sign of possible momentum, Senate Majority Leader Charles E. Schumer (D-N.Y.) wrote to lawmakers Friday that the upper chamber could consider the bill — along with measures to regulate TikTok, address rail safety and lower health-care costs — “in the weeks and months ahead,’” the Post reported.

The tax reform legislation was approved with bipartisan support in the House, but it hit a snag in the Senate, where some Republicans have been opposed to a provision that would expand the child tax credit.

What gives: Small businesses have been especially hard hit by the change that went into effect in 2022. And the window may be closing for passage, as the Wall Street Journal reported a few weeks ago.

Business advocates warned that some companies hardest hit might not survive if the changes aren’t made retroactive during this Congress. “What you’re asking these small businesses to do is provide an upfront loan to the federal government on the theory that maybe they’ll get paid back in 2026,” said Neil Bradley, executive vice president of the U.S. Chamber of Commerce. “That’s just not viable.”

DOMESTIC MANUFACTURING

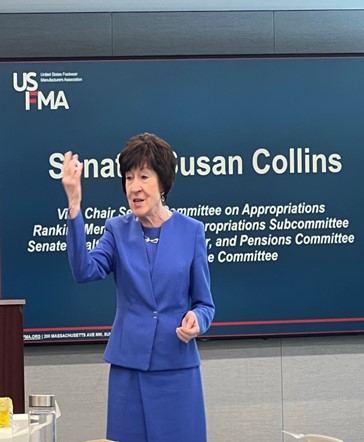

SPRINGING FORWARD: The United States Footwear Manufacturers Association hosted Sen. Susan Collins, vice chair of the Senate Appropriations Committee, and other government and industry leaders at its spring meeting in Washington hosted at SMI.

SPRINGING FORWARD: The United States Footwear Manufacturers Association hosted Sen. Susan Collins, vice chair of the Senate Appropriations Committee, and other government and industry leaders at its spring meeting in Washington hosted at SMI.

Game time: Reps from more than two manufacturers and suppliers who attended also heard from Catherine Lea and Charles Cartier, research scientists at the Center for Naval Analysis who participated in the Defense Logistics Agency Clothing & Textile wargame that assessed the domestic textile industry’s ability to meet wartime demands.

‘Keeping pace’: On day two, SMI coordinated meetings for attendees with the staff of some 30 Senate and House members.

A leading agenda item for the FY25 budget cycle is to enlist support from Congress for $10 million in military footwear research to ensure troops have more choices to meet the requirements of the Berry Amendment, which restricts the use of federal funds for clothing, fabrics and other textiles “not grown, reprocessed, reused, or produced in the United States.”

“The Army lacks the resources — funding, facilities, and personnel — to ensure that the Berry Amendment footwear industrial base is keeping pace with new materials, manufacturing technologies and design,” USFMA executive director and SMI president and CEO Bill McCann, told POLITICO Influence.

Closing the loop: USFMA also made a strong case for Congress to pass the Import Security and Fairness Act to close the trade loophole that allows packages valued at less than $800 to avoid customs duties and taxes.

A new pair: USFMA also welcomed two new members: Okabashi, which manufacturers eco-friendly and 100 percent recyclable flip flops and sandals in Georgia, and Lalaland Design, a premier leather footwear maker based in Los Angeles.

Related: Blumenauer: End exemption for uninspected packages from China

FORGING AHEAD: Congress has stepped in to invest in the casting and forging industrial base, a sector that often gets overlooked when it comes to beefing up our manufacturing capacity.

The Forging Industry Association, an SMI client, will leverage $5 million included in the recently signed FY24 Defense Appropriations Act to conduct research and development on robotics and other automated and simulation tools to improve production processes and diversify source materials.

“This historic investment will help accelerate the rate our industry can provide forgings for critical applications to ensure defense readiness and national security,” said FIA President and CEO Jim Warren.

‘Go-to-war weapon systems’: President Joe Biden’s 2022 executive order on Securing Defense-Critical Supply Chains highlighted the need to strengthen the casting and forging industry that processes metals and alloys for a wide range of weapons platforms because “many of these parts are high importance/low-volume and minimal demand items that support critical go-to-war weapon systems and platforms.”

Read up: FIA On the Issues

MEETING DEMAND: SMI client Metallus Inc., a leader in high-quality specialty metals, inked a new partnership with the Army that will invest up to $99 million to increase the production of artillery shells depleted by allied support for Ukraine.

“With this funding, we intend to further optimize our assets to meet the Department of Defense’s heightened demand, while reducing our carbon footprint,” said President and CEO Michael Williams of the company, which was recently rebranded from TimkenSteel Corporation.

TECHNOLOGY

LINC-ING UP: SMI client University of Massachusetts Lowell in March unveiled a nearly $800 million private-public partnership to transform the state’s largest public university into an unsurpassed national leader in STEM education and technological innovation in everything from robotics and AI to space technology and environmental solutions.

LINC-ING UP: SMI client University of Massachusetts Lowell in March unveiled a nearly $800 million private-public partnership to transform the state’s largest public university into an unsurpassed national leader in STEM education and technological innovation in everything from robotics and AI to space technology and environmental solutions.

The Lowell Innovation Network Corridor will leverage new and existing partnerships nationwide to develop a 1.2 million square foot nerve center of innovation, along with hundreds of units of new housing for young professionals and students.

‘Incredible opportunities’: The historic investment will bring an estimated $3.7 billion in economic activity over the next decade, according to the UMass Donahue Institute.

“The LINC will generate billions in economic activity, create thousands of jobs and hundreds of units of urgently needed housing, and expand workforce training for our students,” Massachusetts Governor Maura Healey said. “We’re grateful for the partnership of Congresswoman Lori Trahan, the City of Lowell, and the University of Massachusetts to make this transformative project possible. We welcome the addition of Draper to the LINC Project and hope that other innovators will see the incredible opportunities here in Lowell.”

‘Dramatically scale up’: “UMass Lowell has a wide range of top-tier faculty expertise, and we partner with organizations across many different industries,” added Julie Chen, UMass Lowell chancellor. “UMass Lowell will be able to dramatically scale up research around aerospace, human performance, advanced textiles, robotics, sensors and many other sectors that will bring a diversity of education and job opportunities to Lowell.”

The project will begin with the transformation of the Wannalancit Mills site, a restored 19th century textile mill, into a “factory of the future” with dedicated floors for biotechnology and medical devices, space technology, environmental sensing and climate technology, cybersecurity and artificial intelligence, and human performance.

SMI’s role: “I look forward to supporting this incredible effort that enables Lowell to lead the next technology and innovation revolution,” said SMI President and CEO Bill McCann.

Read more: Governor Healey Announces Transformative Economic Development Project in Lowell

Plus: Draper Labs to anchor new UMass Lowell development

BASED ON MERIT: The Government Accountability Office published its assessment of the role of multi-award winners in the Small Business Innovation Research/Small Business Technology Transfer (SBIR/STTR), underscoring the unique and critical role played by innovative companies whose proposals have repeatedly been deemed most meritorious.

Among GAO’s findings:

— SBIR-derived technologies for such mission-oriented agencies have a lower adoption rate due to their specialty applications, longer timelines for development, and the changing needs of sponsoring agencies.

— The higher rates of awards to multi-award winners at DoD are in large measure due to their dedicated testing, training, contracting, IT, and business processes.

— Multi-award winners are regularly selected for technologies that meet specific agency needs without wider applications, which limits their potential to be commercialized and attract private investment compared to other awardees.

— The number of patents and commercialization rates by multi-award winners often do not present a comprehensive view of outcomes, due to the acquisition of their innovations by larger businesses, the transition of knowledge to other programs, and principal investigators who often apply their SBIR discoveries to other businesses or industries.

— There are no specific barriers to entry in the SBIR/STTR programs for other small businesses, which GAO found to have similar Phase II award rates as multi-award winners. Nor do multi-award winners crowd out other businesses by any accepted measure of market concentration.

Hot takes: SMI clients Physical Sciences Inc., which was interviewed by GAO, and CRG commended the congressional watchdog for reflecting their long experience supporting the Departments of Defense, Energy, Homeland Security, and other participating agencies.

“The GAO’s findings and their ability to provide an objective view of how multi-award companies have performed under the SBIR/STTR program supports CRG’s position regarding the new SBIR/STTR benchmarks and their impact on innovative small businesses,” said CRG President Christopher Hemmelgarn. “We strongly believe that the most disruptive solutions come from non-linear, combinatorial innovation and the ability to leverage knowledge and know-how across programs and domains, which is enabled through the continued funding of multi-award organizations.

Looking ahead: “We hope this report ends the debate about multi-award winners and that the program can be permanently authorized so companies like ours can invest in these important technologies for the future,” PSI President and CEO Bill Marinelli stated.

Hemmelgarn added: “Restricting the number of awards to any small business would simply reduce the quality of the innovation that can be provided. The GAO’s conclusions help to ensure the future SBIR/STTR programs will continue to provide the quality of innovation we see today.”

Read more: Physical Sciences, Inc. lauds GAO review of leading recipients of SBIR awards

ICYMI: Biden administration announces $6.6 billion aid package for Taiwan Semiconductor giant

DEFENSE AND SPACE

PLUGGING THE GAPS: When it comes to improving the health of the U.S. defense industrial base, all eyes are on SMI client Govini, which is leading the way in identifying major vulnerabilities in the U.S. supply chain and the solutions for plugging them.

PLUGGING THE GAPS: When it comes to improving the health of the U.S. defense industrial base, all eyes are on SMI client Govini, which is leading the way in identifying major vulnerabilities in the U.S. supply chain and the solutions for plugging them.

Most recently, it is driving the conversation on strengthening the domestic supply chain for advanced batteries and ways to improve the Defense Production Act Title III that makes targeted investments in industrial base capabilities.

‘The depth of the challenge’: “Data generated by Ark, the leading acquisition software platform, illustrates the depth of the challenge,” Jeffrey Nadaner, former deputy assistant secretary of defense for industrial base policy and Govini’s senior VP for government affairs, detailed in a fresh report. “Between 2020 and 2023, China’s exports to the United States of battery types and components — lithium, nickel cadmium, parts, and primary cells — swelled sevenfold, from roughly $2 billion to $14 billion,”

Some steps that can be taken now:

— Impose “a much stiffer tariff” on battery content originating in China, including “imports from otherwise friendly trading partners that Chinese materials and components pass through enroute to America.”

— Provide extensive tax credits for the capital expenditures to process minerals and make battery components.

— Use the National Defense Authorization Act policy legislation to accelerate the Pentagon’s shift away from reliance on Chinese-based battery materials.

Strengthening DPA Title III: Meanwhile, retooling DPA Title III is another imperative, Nadaner testified before the House Financial Services’ Subcommittee on National Security, Illicit Finance, and International Financial Institutions.

Some proposed actions:

— establishing loan guarantees to facilitate private sector investments in military supply chain gaps and defense sector infrastructure.

— adding government experts in energetics; critical mineral processing, metallurgy and materials; electronics; castings and forgings; machine tools and advanced manufacturing; weapons computing; shipbuilding and maintenance; and defense supply chain management.

— allowing DPA Title III funds to be used to recruit and train machinists, welders, electricians, chemical technicians, assemblers, pipefitters, and more.

— adopting three months as the standard deadline for DPA Title III award decisions.

Top doc: Navy Long-Range Shipbuilding Plan

Plus: DOD Commercial Space Integration Strategy

And: State of the Space Industrial Base

LIFE SCIENCES

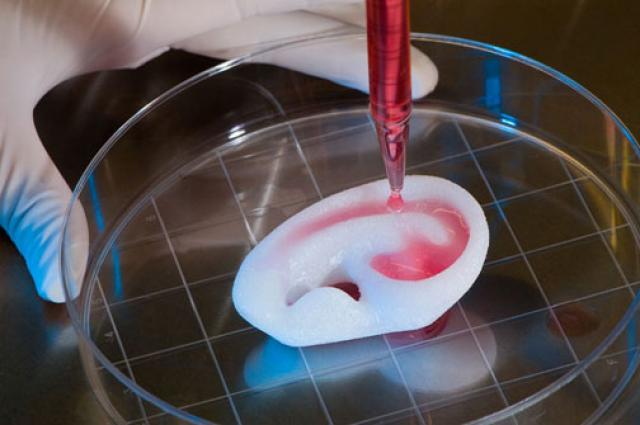

REVIVAL: SMI is helping clients pursue a unique opportunity to push the boundaries of military medicine.

REVIVAL: SMI is helping clients pursue a unique opportunity to push the boundaries of military medicine.

The Armed Forces Institute of Regenerative Medicine is seeking to finance new therapies in the areas of craniomaxillofacial regeneration; extremity regeneration; genitourinary/lower abdomen reconstruction; skin regeneration; ex-vivo/on demand blood; and cellular therapies for trauma and critical care.

The initiative is “focused on supporting regenerative medicine clinical trials to improve prevention, detection, diagnosis, treatment, and/or quality of life,” the request states. “Awards made from this effort are intended to support a clinical trial having FDA approval, an FDA exemption, or for overseas trials.”

Timeline: White papers are due April 30.

Contact SMI VP Travis Taylor for more info.

CLIENTS IN THE NEWS

UMass Lowell embarking on strategic expansion

Cambridge-based government contractor Draper is set to grow in Lowell