Welcome to the April edition of A Capitol View

The Pentagon’s new annual budget plan may be the largest ever, but it’s banking heavily on small businesses to reignite the defense industrial base.

That’s a major takeaway from President Joe Biden’s $886.3 billion request for national defense — including $842 billion for the Pentagon — that’s now being picked over on Capitol Hill.

The director of DoD’s Office of Small Business programs told a Senate panel that the department is trying to reverse the decade-long slide in the number of small businesses contracting with the military. “This is an economic and national security risk for our nation,” Farooq Mitha testified on March 24. “We risk losing mission-critical domestic capabilities, innovation, and strong supply chains.”

Shark Tank: The head of the Army’s Office of Small Business Programs, Kimberly Buehler, talked up what she called “Shark Tank-like” competitions, telling the Senate Armed Services Committee that the service plans to use more novel acquisition approaches, including “other transaction authority,” to expand “low-barrier-entry” for new contractors.

Mitha also highlighted the Mentor-Protege Program, the Rapid Innovation Fund Program, the APEX Accelerators, and the Indian Incentive Program.

She said the department “is working to strengthen our small business supply chains, increase competition, and attract new entrants” and vowed “to reduce barriers for small businesses such as confusing points of entry into defense markets, contracting challenges imposed by improper bundling, and consolidating of contracts.”

Capacity building: The goal is to beef up the industrial base and the domestic supply chain for technologies ranging from semiconductors to critical materials.

DoD’s proposed budget invests in five priority areas in support of the defense industrial base: microelectronics ($2.6 billion); castings and forgings ($177 million); batteries and energy storage ($125 million); strategic and critical materials ($253 million); and “kinetic,” or explosive weapons ($441 million). The Pentagon has set aside $2 billion for weapons factories and depots, aiming to double monthly production of 155mm artillery shells, Javelin anti-tank missiles, and launchers.

“It’s encouraging to see the Biden Administration continue to prioritize the defense industrial base with a robust funding request, particularly for the Defense Production Act Title III and Industrial Base Analysis and Sustainment programs,” says SMI COO Ken Wetzel. “It’s important that the U.S. continues to not only lead near-peer adversaries in creating cutting-edge weapon systems but also ensure that domestic manufacturing operations have the necessary capabilities to deliver them to the warfighter reliably and efficiently.”

A difference a year makes: SMI Analyst William Willkomm crunched some numbers to see how much DoD industrial base programs are up in the new budget. Between FY23 and FY24 they increased 35 percent from $1.75 billion to $2.5 billion. “The majority of that increase comes from significant requests for DPA Title III and IBAS,” William reports.

‘TETRIS EFFECT’: But will defense spending be derailed by politics? Lots of pieces will need to fall into place this year to reach a consensus on the dozen annual appropriations bills. SMI VP Maria Bowie calls it the “Tetris Effect,” in reference to the puzzle video game.

“With a four-vote margin,” she says, House Speaker Kevin McCarthy “will have a hard time passing a dozen annual spending bills with a Republican conference that often can’t agree on basic fiscal issues.”

Some GOP lawmakers also want to cap the Pentagon’s budget at fiscal 2022 levels, which defense leaders are warning would hamstring efforts to outpace adversaries like China. Party leaders are also demanding spending cuts in return for raising the debt ceiling later this year so the government can borrow more money.

What’s in store for programmatic increases? “The House has continued with programmatic plus-up requests from members and agreed to some community projects, viewed by some as earmarks, with new constraints,” Maria notes.

Nevertheless, “the GOP’s disdain over earmarks and demands to cut spending will add to appropriators’ burden, as the debt limit raises the stakes in the debate to fund the government before a shutdown strikes in September,” she added.

End game: Maria sees the House voting for a higher level of defense funding than for non-defense programs, while the Democratic-controlled Senate prioritizes non-defense funding. She predicts year-end negotiations, after resolving the debt limit, create a bill that the majority of the House and Senate can vote for that has a similar number for defense and non-defense that we had in fiscal year 2023.

DOMESTIC MANUFACTURING

‘GUARDRAILS’: The Department of Commerce has released a notice of proposed rulemaking outlining the “national security guardrails” for recipients of CHIPS Act funding to ensure the money “is not used for malign purposes by adversarial countries against the United States or its allies and partners.”

The notice follows the first notice of funding opportunity for semiconductor manufacturing under the CHIPS Act — the first of three expected this year — focused on existing commercial fabrication facilities for semiconductor technologies.

‘INVEST IN AMERICA’: SMI client Wolfspeed, Inc., which provides 60 percent of the world’s silicon carbide — the naturally occurring chemical that includes silicon and carbon — was the first stop on President Joe Biden’s “Invest in America” tour.

Silicon carbide is “essential to accelerating the adoption of EVs, delivering energy savings to consumers, and meeting global emission reduction targets,” said Wolfspeed President and CEO Gregg Lowe. Biden, in touring the company’s Durham, North Carolina, headquarters, vowed: “We’re determined to lead the world in manufacturing of semiconductors. We invented semiconductors in the United States of America.”

‘FOUNDATIONAL GAP’: The Pentagon has published a new Biomanufacturing Strategy, supported by a $1.2 billion investment plan, to expand domestic capacity for using biological mechanisms to produce defense materials, warning that “it is only a matter of time before U.S. companies also go to China for biomanufacturing.”

“The United States faces a foundational gap in the ability to scale up bio-industrial manufacturing from laboratory research and development to commercial-scale production due to the insufficient network pilot-scale biomanufacturing infrastructure to validate a technology or product,” Heidi Shyu, the undersecretary of defense for research and engineering, wrote in the introduction.

DoD followed up with a Request For Information (RFI) to gather data about industrial base shortcomings that could be addressed with funding under the Defense Production Act. Some areas of interest include biofuels, biosynthetic fibers, and self-healing materials. Submissions are due April 19.

ENERGY

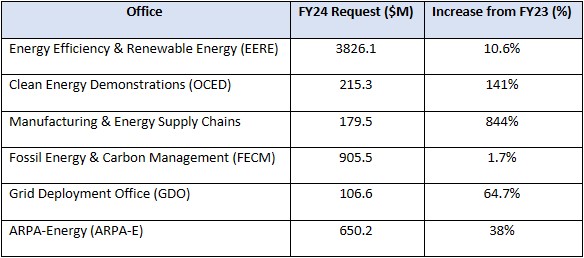

BUDGET PRIORITIES: The Department of Energy’s new budget request for FY24 came in at $52 billion, $4 billion above what was enacted for Fiscal Year 2023.

Some highlights:

WHERE CREDIT IS DUE: The Treasury Department is out with proposed guidance on tax credits for clean vehicles under the Inflation Reduction Act.

The guidance issued on March 31 “provides clarity and certainty to manufacturers on the Inflation Reduction Act requirements that vehicles eligible for the clean vehicle credit undergo final assembly in North America and do not exceed a Manufacturers Suggested Retail Price of $80,000 for a van, pickup truck, or sport utility vehicle, or $55,000 for any other vehicle,” Treasury says.

SUSTAINABILITY PUSH: The Society for the Advancement of Material and Process Engineering convenes in Seattle on April 17 and will feature a panel discussion on how the energy, aviation, and consumer products industries are prioritizing decarbonization, waste reduction, energy efficiency, and taking other steps toward greater sustainability.

The panel, which will be moderated by Daniel Coughlin of Oak Ridge National Laboratory’s Institute for Advanced Composites Innovation, will feature SMI client Huntsman Advanced Materials; Boeing; Airbus; TPI Composites, Inc.; Specialized Bicycle Components; and Cygnet-Texkimp.

BILLIONS IN NEW FUNDING: The Department of Energy’s Industrial Demonstrations Program in March released a new funding opportunity topping $6 billion “to accelerate decarbonization projects in energy-intensive industries.”

Proposals are due April 21. The details can be found here.

RESEARCH AND DEVELOPMENT

NEW R&D STRATEGY COMING: The Pentagon in the coming weeks plans to release a new National Defense Science and Technology Strategy. Shyu previewed its major themes for the House Armed Services Committee — including planting the “seed corn” to “ensure a strong future foundation by cultivating talent, strengthening our physical and digital infrastructure, pursuing basic research, and growing collaborative connections that reinforce our work.”

Overall, the Pentagon is requesting $145 billion in FY24, its largest amount ever, for research, development, test and evaluation. That’s up four percent and includes $115 million for the newly established Office of Strategic Capital, which is making a new push to woo Silicon Valley to enlist private capital to invest in new technologies deemed critical for national defense.

A TAXING TIME: SMI is also closely tracking how a new tax provision that requires companies to deduct annual research and development costs over five years is hitting small businesses. The changes to section 174 of the IRS Code that went into effect last year are considered an “urgent issue” by advocates for firms that rely on the Small Business Research Innovation and Small Business Technology Transfer programs.

The Small Business Technology Council, speaking on behalf of hundreds of small firms, warned congressional overseers that the change “will have a chilling effect on American R&D in general, but it will particularly harm and disincentivize R&D focused small businesses like those participating in the SBIR and STTR programs.”

Over 500 CEOs and small business leaders warned in a separate letter that if not fixed the tax reform “could destroy innovative small businesses,” citing one public research university that concluded the tax provision “could bankrupt almost every one of their ten SBIR startup companies.

LIFE SCIENCES

OUT OF BOUNDS: The new Advanced Research Projects Agency for Health at the National Institutes of Health has issued its first broad agency announcement for disease research that emphasizes evolutionary approaches to treatments.

The effort is designed to tackle diseases that “affect large populations, rare diseases, or diseases for which treatment options are limited.”

Risk taking: Officials recommend reading following the Heilmeier Catechism, an approach named for a former head of the Defense Advanced Research Projects Agency, to take big risks. But organizations with more than three active awards with ARPA-H will not be eligible for additional awards.

ARPA-H also released more information about the site selection process for three “hubs” to advance its mission. One in the National Capital Region will serve as the administrative headquarters; another will be designated the “customer experience” site; and the third will act as an investor catalyst to help commercialize concepts.

SMI IN THE NEWS

‘RADICAL NEW MODEL’: The United States Footwear Manufacturers Association added to its growing roster of members with KX, Inc., which boasts the 36,000 square-foot KX Lab in Los Angeles that combines production, R&D, showroom, and retail space all under one roof.

“The goal of this radical new model for manufacturing is to bring consumers, products, and the people that make them closer together,” says SMI CEO Bill McCann, who serves as executive director of the footwear association. “It is the KX’s first US factory, a prototype for larger facilities currently being planned in cities across the country and around the world.”

More: This robotic knitting factory might make your next pair of sneakers.

READING ROOM

Innovation for Resilience: A Focused Study on Workforce, Climate, Supply Chain, and Cyber Resilience

EVENTS

The Navy League’s annual Sea-Air-Space exposition kicked off today in National Harbor, Md.

The National Defense Industrial Association’s Emerging Technologies Institute and the Potomac Institute are offering a course on April 12 on the policy and technical challenges relating to critical minerals and rare earth elements.